How Do Plan Sponsors Move Forward?

August 12, 2020

The year 2020 will be remembered for a multitude of reasons. We’ve had a pandemic, a recession, an extended period of civil unrest and all during a presidential election year. With all of these events taking place in such a short period of time, this will certainly be one for the history books. The question facing most business owners and plan sponsors is “what is the plan now?”

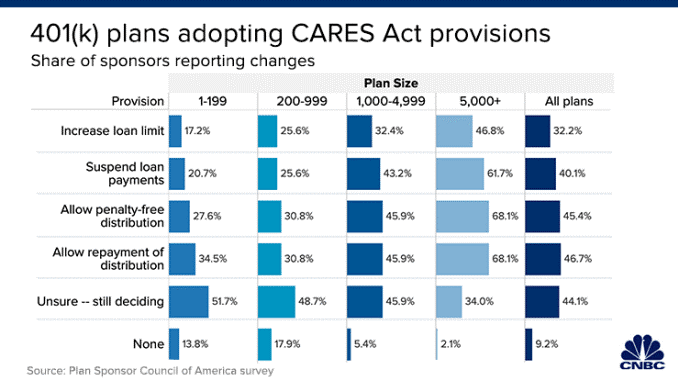

Some of you may have taken advantage of the governmental offerings via loans and deductions or even amended your retirement plan to include the CARES Act provisions, allowing participants access to their retirement account(s) for emergency funds. In doing this, you’ve allowed employees access to their retirement that likely helped get them through tough financial times and that’s a great service to your team. The chart below, created by the Plan Sponsor Council of America from a recent survey, shows the percentage of plans electing each CARES Act provision.

It was reported in late April, according to Fidelity, that plan values sunk 19.2% versus closing 2019 balances, mostly due to the pandemic. Of course, as I’m writing this in August, markets have bounced back, though volatility is still a factor. As we begin to move forward, or at least back towards normal, I wanted to lay out three thoughts I have around “retirement recovery efforts.” In other words what can we, as financial advisors, do to help support you as plan sponsors during the recovery phase and how can we partner together to create an effective plan moving forward? Let’s take a look at three opportunities available, leveraging your plan’s financial advisor to initiate the retirement recovery process.

Increased Education

The first opportunity should always be education. As Ben Franklin once said “An investment in knowledge pays the best interest.” Leverage your plan’s financial advisor to provide seminars for employees regarding the importance of saving for retirement or other financial topics relevant to your staff and situation. You could also ask your advisor to spend a day at your office or use technology to connect employees with your advisor. We have a best practice that has proven to be effective in this space that we’d love to share with you. Please reach out to me and I’ll go more in depth about our education process.

Evaluate Investment Lineup

Maybe now is not the right time to increase education for your staff, and that’s okay. Perhaps instead, now would be a great time to ask your advisor to evaluate your plan’s investment lineup to ensure the investments available in your plan are still on track to meet their listed objectives both now and in the future. This is also an obligation you have to employees as a fiduciary, but also that your advisor has to you and your team. Your investment lineup should provide a diverse group of funds that empowers employees to create portfolios in line with their personal savings goals.

Plan for the Future

Finally, start thinking about the future, both as a company and a plan sponsor. Is your plan meeting its current objectives and does it provide a suitable platform for employees to meet theirs? Is there something you as a plan sponsor could do to improve the overall plan experience for everyone involved? Just a few thoughts to consider are: Could you allow for earlier access to the plan for new employees? Could you provide an additional contribution or increase future employer contributions? Does it make sense to expand access to emergency funds via the plan? This may not be the time to make changes and there are certainly other options to consider. Aside from ensuring your plan is designed to meet its current and future objectives, consider ideas around helping you and your team reach retirement readiness. Take this time to examine and reaffirm the purpose of the plan. Most TPA’s and recordkeepers offer free assessments or a plan health report designed to assist with the evaluation process. Now would be a great time to take advantage of these, using your advisor to help guide you through the process and into the future.

It goes without saying that each plan sponsor and company will have their own unique set of circumstances and/or challenges in making some or all of this happen. It’s not lost on our team that many businesses are experiencing or have experienced hardship during 2020. Know that you are not alone! We are all in this together. We would welcome the opportunity to get to know you and your team and share some of our best practices – contact me anytime.

Matt Kruckenberg, QKA

(614) 907-8639

Matt.Kruckenberg@JosephGroup.com