A Recap of this Week’s Portfolios & Pints

September 12, 2025

To Inform:

This week The Joseph Group had the joy of hosting clients and friends of the firm for our Oktoberfest themed “Portfolios & Pints.” As is our annual tradition, Joseph Group CEO Travis Upton and I pulled questions from a hat that had been submitted by clients ahead of time. Such a format means we end up covering a lot of ground, but I thought it would be worth sharing a few big questions that were asked at this week’s event.

One question that came through was around the impact on markets if the Supreme Court rules against the Trump administration’s application of tariffs as a lower court recently did. While we likely won’t have a decision until closer to year-end at the soonest, we can estimate what the ramifications might be. First, it is possible the administration will have to refund the tariff revenues collected. Later in the year, one research firm we follow projects that the US Treasury will have collected over $200 billion in tariff revenues. The Treasury, not currently planning for such an outlay, would be forced to scramble to the bond market beyond their regular issuance cadence. We think that it could, at least in the near-term, put upward pressure on bond yields. The uncertainty of such an event and its impact on the government’s finances could also positively impact gold, something many are viewing as an alternative asset that benefits from fiscal irresponsibility.

Longer term, we think tariffs stay. The administration has several other levers they can pull with clear legal justification to implement their tariff policies. Given how serious the administration seems to be about tariffs, we would expect any short-term hiccup to be exactly that.

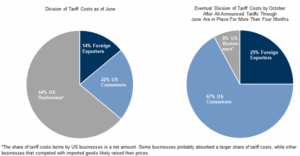

Another question had to do with when we are likely to see sustained upward pressure on inflation as it relates to tariffs. Our best guess is that we see it sometime this fall, but it is likely to be limited. The chart below from Goldman Sachs shows the bank’s estimates as to where tariff costs are being absorbed. Their analysis concluded that through June, the bulk of the impact was being shouldered by businesses and foreign exporters. As the year goes on, Goldman expects consumers to begin bearing more of the cost of tariffs. This will put some upward pressure on goods likely over a short period of time. That said, inflation is still largely being driven by services, which don’t have as clear a connection to tariffs. Here, shelter costs remain the biggest component.

Source: Goldman Sachs

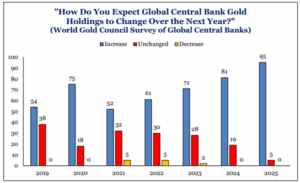

Finally, one of the most amusing questions of the night was about the prudence of gold and silver investments given the fact that Tom Selleck is pitching them on cable television commercials. After some jokes about whether or not I knew who Tom Selleck was (of course I do, “Mr. Baseball” was some of his finest work), Travis and I agreed that though gold has been on a tear in 2025 and is owned in many client portfolios we have the privilege of managing, it functions very differently than dividend-paying stocks or bonds. One primary difference is that it doesn’t provide cash flows. Returns in gold are decided entirely by what a potential buyer is interested in paying for it. Gold remains in many client portfolios given foreign central bank demand (shown in the chart below), the fiscal largesse we see globally, and a backdrop of higher geopolitical risk. That said, our view is that something as unique as gold should be viewed as a diversifier in portfolios and not a core holding.

Source: Strategas

If you weren’t able to make this week’s event and have a question about anything markets-related don’t hesitate to reach out. While we can promise an answer, we can’t promise it will be as fun as being with a crowd of great people, good food, and good drink!

Written by Alex Durbin, CFA, Chief Investment Officer