A Strange Fed Easing Cycle – Or is it?

October 25, 2024

To Inform:

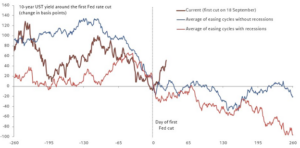

After one of the longest “pauses” – that is, the period between the last hike in the Federal Funds rate and the first cut – in US history, the Federal Reserve Open Market Committee cut interest rates by 0.5% last month, surprising many who were expecting a cut of 0.25%. This first of what is expected to be many cuts had bond investors and borrowers excited over the potential for lower interest rates that would boost bond prices and unlock a frozen housing market. Interest rates since September have indeed fallen, but only in the shortest-dated parts of the bond market. Interest rates on further dated maturities, like the US 10 Year Treasury, have risen since the Fed cut rates. This isn’t the Fed easing cycle I was promised, is it?

To answer this question, it’s important we distinguish which type of easing cycle we’re experiencing. The chart below is a little messy, but it shows the change in the interest rate on the US 10 Year Treasury Bond in the year leading up to the first cut of an easing cycle and the change in the subsequent year. The brown line that is yet to be completed is the current cycle. The red is the average performance in easing cycles accompanied by recessions. In those episodes, the interest rate falls substantially throughout the course of the easing cycle. The blue line shows the average performance in easing cycles not accompanied by recession. Here, the 10 Year Treasury Bond rate exhibits much of its decline in the leadup to the first cut but doesn’t move much further after that.

Source: X.com, formerly known as Twitter

Before we get to the implications, it is perhaps best to explain why rates are moving the way they are. The best explanation is usually the one that is the most obvious, and that is that the economic data of late is coming in better than expected. The chart below shows the Citigroup US Economic Surprise Index. Note that after declining for much of 2024 the economic surprise index has begun trending higher again. In other words, the last few months of economic data have come in better than forecasts were predicting. What do we know about interest rates and economic growth? Generally, the stronger economic figures are, the higher interest rates (particularly longer maturities) are likely to be.

Source: X.com, formerly known as Twitter

As time goes on, expect the market to get a better handle as to the path of future interest rates. It’s striking to us that at one point in September the market was pricing in a number of cuts that would imply a decrease of 2.5% on the Fed Funds rate by year end 2025. For reasons espoused above, the market has quickly dialed that back to a more reasonable expected decrease of 1.5%.

Source: Strategas

What does this mean for borrowers and bond investors? Well, for borrowers, don’t expect mortgage rates or car loans to behave like they have in some of the recent easing cycles that were accompanied by fears of slowing economic growth (2008, 2020). It is very possible that the recent low observed on the US 10 Year Treasury of 3.6% isn’t breached without a serious deterioration in economic data. For bond investors the added bonus of increasing bond prices that accompanies falling interest rates may be elusive. That said, with interest rates on the US Bond Aggregate Index at 4.65%, on corporate bonds above 5%, and high yield bonds above 7%, you could do a lot worse than having some of your money parked in bonds. Where we’re likely to see the least attractive yields as the Fed continues cutting rates is in online savings accounts, money markets, and CDs as interest rates on these instruments tend to be much more correlated with moves in short-term interest rates.

So, while it may feel like this easing cycle is different, the behavior of interest rates since the Fed’s cut in September is less surprising when we consider the economic data. While this may force us to temper our expectations for the bond market and borrowing money, the alternative, an easing cycle accompanied by steep declines in interest rates may be a double-edged sword. With easing cycles and just about anything else, be careful what you wish for!

Written by Alex Durbin, CFA, Chief Investment Officer