Do Stock Splits Add Value?

April 5, 2024

To Inform:

I recently had a conversation with a friend and client regarding potentially selling shares in a stock he owns. During the conversation he said, “I read something that the stock may split. If that happens, I feel like I should hold on to make sure I capture the gains after the split.”

Huh. I found that thought interesting. As someone who has read a lot of finance textbooks, academia would tell you a stock split is irrelevant when it comes to performance of a stock. The math behind a split merely changes the shares and dollar price of the stock, but the actual value for the position is the same.

For example, let’s assume an investor owns 100 shares of ABC Company, which is priced at $50 per share. The value of the position is:

100 shares X $50 = $5,000

Now, let’s assume ABC Company has a 2 for 1 stock split. The number of shares double to 200, but the stock price is cut in half to $25. The math post-split shows a value of:

200 shares X $25 = $5,000

As you can see, the math of the stock split does not change the value of the position.

Now, I’ve read a lot of finance textbooks, but I’ve also been involved with investing long enough to know market behavior doesn’t always follow textbook logic.

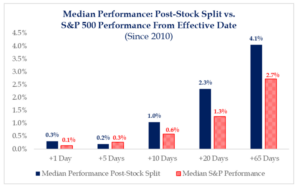

Jason Trennert, Chief Strategist for Strategas Research Partners, recently looked at market data since 2010 and results showed stocks of companies that split their shares outperformed the broader market by a meaningful margin in the two months following the split date. Compared to the median S&P 500 stock, companies which had a stock split tended to have a relative boost the day after the split, gave back some of that relative performance in the next week, but then went on to outperform in the two weeks to two months following the split.

Source: Strategas Research Partners

Why? If the finance textbooks say the value of a stock position isn’t impacted by a stock split, how do we explain the performance lift we see in markets? We’re only guessing, but here are a few thoughts:

- Splits make it easier for retail investors to buy a stock. Although some brokers may allow investors to purchase fractional shares of certain stocks, traditionally, stocks have been purchased in whole shares and often in round lots of 100 shares. A smaller share price makes it easier to buy whole shares or round lots and therefore adds to demand by attracting new individual investors.

- Splits may encourage speculation. I’m reminded of an old commercial for jams and jellies which paraphrased says, “with a name like that, it has to be good!” Finance theory aside, splits have a positive reputation and may encourage speculators to think, “a stock that has split has to be good!”

- The stocks which split tend to be great companies. The theory here may go in the “well, duh” category, but it also may make the most sense to explain post-split stock behavior. A stock is more likely to split when it has a high stock price. The high stock price is in turn most likely to happen after a company has had a period of great performance. As our Chief Investment Officer, Alex Durbin, often reminds us “momentum often begets (yes, Alex likes to say words like begets) momentum.” New highs are not necessarily a reason to sell as new highs often lead to further gains.

So, what did I say to the client who wanted to hold on to his stock in case of a stock split? I said, finance theory says you are being illogical, but practicality says your idea may be brilliant.”

Written by Travis Upton, Partner and CEO