2025 Capital Market Assumption Takeaways

December 13, 2024

To Inform:

Earlier this week we held our December Portfolios and Pints event. As part of the discussion, in what has become a bit of an annual tradition, we shared an updated summary of “Long Term Capital Market Assumptions.”

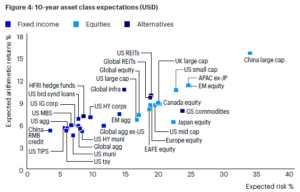

It’s an intimidating sounding term, but “Capital Market Assumptions” (borrowing phraseology from JP Morgan) “provide return and risk expectations for various assets and strategies over a 10+ year time horizon. These assumptions guide investors in making strategic portfolio decisions. Factors such as growth, interest rates, and geopolitical tensions impact these expectations.” Below is a sample chart from one firm’s output looking at different asset classes:

Source: Invesco. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.

In other words, economists and different firms crunch a whole bunch of numbers related to the global economy, valuation, interest rates, earnings, etc., and based on the data, come up with risk and return forecasts for different asset classes over the long-term. We can then apply this data to help guide investment allocation decisions when building portfolios.

Each year, The Joseph Group pulls the Long-Term Capital Market Assumptions (LTCMA) from multiple firms such as JP Morgan, BlackRock, Invesco, and Prudential Global and puts together a one-page summary of the data. Summarizing the data is no small feat – the LTCMA from JPMorgan alone is 75 pages!

Here is a summary of four major takeaways:

The asset class with the lowest projected 10-year return was High Quality Bonds with average projected returns ranging from 3.8% – 4.6%. Overall, this makes sense. To quote The Joseph Group’s Chief Investment Officer, Alex Durbin, “Bonds are primarily a coupon investment in this environment. An investor is generally going to earn the interest rate bonds are paying (the current 10-year government bond rate is about 4.3%) although there is some insurance that in a crisis, rates could go down and bonds could experience price appreciation over and above the interest payments.”

Foreign stocks are expected to outperform U.S. stocks over the next decade. In what is probably the most controversial statement on this page, every single firm whose data we summarized had foreign stocks outperforming U.S. stocks over the next 10 years. Why? In short, valuations. Paraphrasing data from the reports, U.S. stocks are historically expensive with “fair value P/E multiples below today’s levels” while “the starting point for valuations is less of a concern for international markets.”

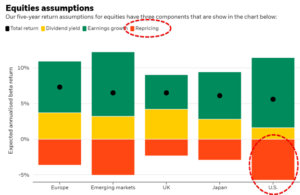

The chart below from BlackRock’s LTCMA provides some perspective. The bars below summarize expected returns by region based on dividends, earnings growth, and “repricing” which is the change in price to earnings (P/E) multiples. According to the data, expected “repricing” for the U.S. is more negative than for other regions (in other words, valuations are expected to come down) resulting in an expected total return which favors foreign markets.

Source: BlackRock Investment Institute. Disclaimer: Expected return estimates are subject to uncertainty and error. Expected returns for each asset class can be conditional on economic scenarios; in the event a particular scenario comes to pass, actual returns could be significantly higher or lower than forecasted.

Real Assets, especially Real Estate Investment Trusts (REITs) and Infrastructure are projected to have returns similar to stocks. Many people think about office buildings when they hear “real estate” but when we look at REITs owned in client portfolios, we see top holdings including data centers, eCommerce warehouses, and nursing homes. Within infrastructure, we see energy companies, oil pipelines, cell towers, and railroads among the significant exposures. Bottom line – Real Assets may be attractive risk/reward diversifiers.

High Yield Bonds have some of the most attractive return relative to risk ratios. During our Portfolios and Pints event, Alex Durbin discussed the current starting income yields for high yield bonds being around 7%. Those starting income rates provide a solid foundation for future returns. In situations where clients are looking for attractive returns with reduced levels of volatility, high yield bonds may be an important tool.

After the event, a good friend and client asked me, “when you look historically, are these capital market assumptions accurate?” Here is how I answered: “They provide a good starting point because they are based on data, but future surprises can and will happen. When you look at the last 10 years, returns for U.S. stocks were much better than expected because earnings growth, especially from big U.S. technology companies, dominated the long-term investment landscape. LTCMAs are not a crystal ball, but since they are based on data, they are a great starting point for separating logic from emotion.”

One final point. Risk is always part of investing and there is bound to be volatility within markets in the years ahead. However, when we look at the 2025 LTCMA across asset classes, long-term asset class returns in the range of 4-8% coupled with the conservative assumptions we use when designing projections should give clients confidence in their long-term financial plans.

Written by Travis Upton, Partner and Chief Executive Officer