401(k) Investors Structurally Set Up for Success During Market Volatility

May 16, 2025

To Inform:

Earlier this week I had a conversation with a friend and business owner for whom The Joseph Group serves as advisor to his company’s 401(k). Here is a summary of part of our conversation:

Friend: “Travis, what did the market do today?”

Travis: “Flat today, but this week the S&P 500 turned positive again year-to-date and has recovered losses from the tariff turmoil.”

Source: Yahoo Finance

Friend: “Wow. Amazing. Did you have anyone who bailed out at the bottom?”

Travis: “Let’s just say that market volatility can cause strong emotions, and we’ve had conversations with participants who inquire about selling everything. Kim [Kline] had one conversation at a time that ended up being the bottom.”

Friend: “That’s tough. One of our employees actually increased his 401(k) contributions when the market went down. He wanted to buy more at lower prices. Then as the market recovered, he adjusted back to his normal contribution.

Travis: “I LOVE hearing that. Matt Kruckenberg and Kim Kline, who oversee our 401(k) Retirement Plan Services, often share that market volatility can be an advantage for 401(k) participants because they are dollar cost averaging. People on your team clearly understand the advantages of buying low and are taking advantage of it!”

I want to pause there to make the key point of this WealthNotes article:

401(k) Investors have a structural advantage when the market is volatile. Because they are investing dollars with every paycheck, they are doing what is called “Dollar Cost Averaging, or DCA.” DCA means they are investing a fixed dollar amount at regular intervals. By consistently investing in both rising and falling markets, investors can accumulate more shares when prices are low, potentially enhancing long-term returns.

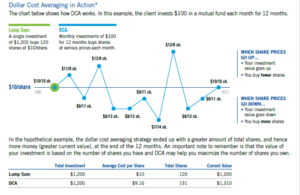

The chart below shows a long-term example of dollar cost averaging. Think of every dot on the chart below as a paycheck. When the market goes down you are buying more shares with the same contribution amount. In this example, even though the price of the fund went on a roller coaster that ended up at the same $10 dollar price it started at, the average cost of shares for the investor was $9.16. Why? They bought more shares when the market was lower. The end result was an overall profit for the investor even though the fund started at a $10 price and ended at a $10 price. It all happened because they stayed disciplined and kept contributing during the dip.

Source: Franklin Templeton

Back to today, the recent market dip after the announcement of tariffs and subsequent 90-day reprieve in those tariffs proved, in hindsight, to be short-lived. As I type, the stock market today is back to levels it was at in early March, before the tariff turmoil. The last two months have been wild, but for 401(k) investors, contributions they made to their plan in the last two months could be the most profitable contributions they make all year.

Investors in 401(k) plans have an advantage in times of back-and-forth market volatility because they are set up for dollar cost averaging. When the market dips, contributions will buy more shares at lower prices. Whenever I talk about this concept with 401(k) participants, it reminds me of one of my all-time favorite investment quotes:

“Investors make most of their money in a bear (down) market, they just don’t realize it at the time.”

- Shelby Cullom Davis

Written by Travis Upton, Partner and CEO