Realism and Optimism: Key to Success

March 13, 2020

To Inform:

The Stockdale Paradox is a concept popularized by the book Good to Great by Jim Collins. The name refers to Admiral James Stockdale who was the highest-ranking U.S. military officer in the “Hanoi Hilton” prisoner-of-war camp during the height of the Vietnam War. According to the concept, balancing realism and optimism in a dire situation is the key to success. Stockdale further explained the idea: “You must never confuse faith that you will prevail in the end – which you can never afford to lose – with the discipline to confront the most brutal facts of your current reality, whatever they might be.

As we look at the situation with COVID-19, we believe the key to success is to balance the realism of where we are today with the optimism of how we will succeed in the future. Let’s discuss both.

Realism of Today

This week, life as we know it has been disrupted for everyone and we are in uncharted territory with no real historical precedent. From school closures, to sports seasons being cancelled, to widespread social distancing – life will be different over the next few weeks, and potentially longer. From an investment perspective, we believe markets will continue to be volatile in both directions as individuals digest news flow. As I type this, the Dow is up over 1,000 points after yesterday, when the market had its worst day since the 1987 crash. In the days and weeks ahead, we will get more news. It is highly likely faster testing will reveal more carriers of the coronavirus. Meanwhile, we are likely to see Congress act with massive fiscal stimulus to support the economy and the market is already pricing in the Fed to cut interest rates somewhere between 0.50% to 1.00% at its meeting next week.

Market-wise, the action we saw yesterday included things which finance textbooks say shouldn’t happen, including higher grade bonds selling off more than junk bonds simply due to a lack of buyers in the market. We believe the reality of today means investors need to be prepared both emotionally and financially to weather the next few months. We will talk more about our portfolios, but in our Conservation (Protect) and Provision (Provide Cash Flow) strategies we have an eye toward acknowledging the difficult reality of life being different. Trying to hinge decisions on every swing of the market is a recipe for insanity. We will hear about positive and negative health and economic ramifications in the weeks ahead…we need to focus on the big picture rather than each individual headline or tick in the market.

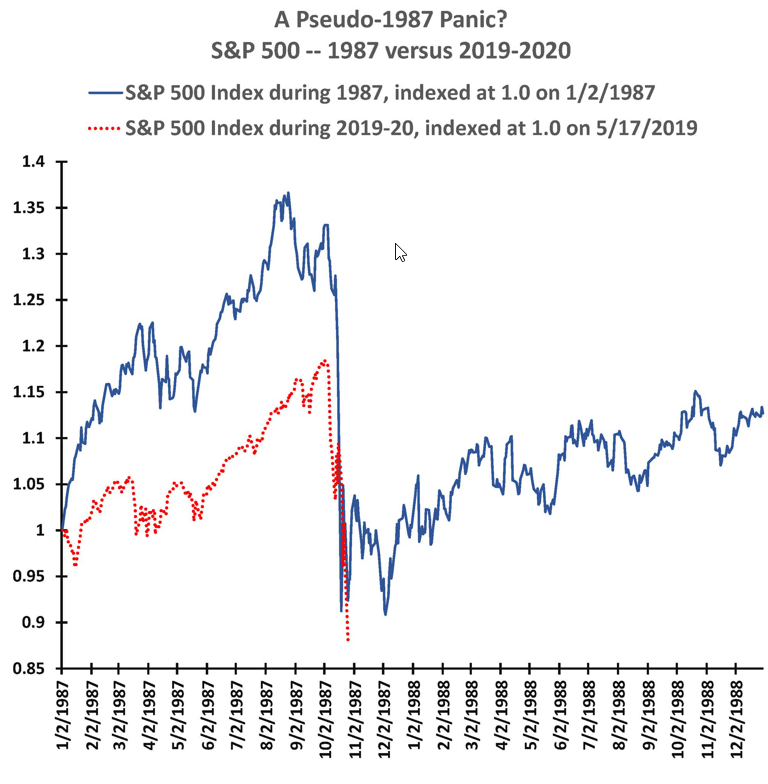

Again, there is no real historical precedent for what we are dealing with the impact of the coronavirus, as comparisons to SARS, MERS and other diseases of the past have already paled to the social and economic impact of COVID-19. That said, Jim Paulsen, chief strategist at The Leuthold Group compared the market impact of the last few weeks to the 1987 crash in the chart below.

Source: The Leuthold Group

While it’s not a perfect comparison of circumstances, the red line shows today’s market action compared with the market’s path in 1987 (the blue line). The similarity lies in the fact that going into the market decline, the economy was near full employment and generally healthy. As you can see with the blue line in 1987, the market’s decline happened all at once and chopped around with an upward trend for the next year. Paulsen goes on to note the market was up almost 30% from its low within the next year and (what is not shown on the chart), the stock market rose to a new high after 18 months.

The Optimism of Future Success

Here is a quote from a report sent out this morning from the noted research firm the Bank Credit Analyst: “After yesterday’s exceptional rout in global equities, BCA Sentiment Indicators have collapsed to the levels record before significant market rebounds, such as the ones which materialized in March 2009 and October 2002. This is not a guarantee the market will rebound in the coming days, but it suggests we have now seen at least three quarters of the selling pressure. Moreover, it indicates the market could now violently rebound on any positive news.”

We will get through this difficult period. Kids will go back to school and we will go to sporting events. When that happens, the backdrop of massive fiscal and stimulus is likely to create a strong tailwind for the stock market.

This morning we received a JP Morgan stock research report concerning a large theme park and entertainment company. The report talked about the earnings slowdown resulting from theme park closures and based on their assumptions, JP Morgan reduced their long-term price target for the company. However, that price target was still 40% above the current price of the stock. This is just one example, but we believe it illustrates a strong opportunity for long-term investors.

Investment Strategy Team Quick Thoughts

- Consistent with the Stockdale Paradox, we are approaching the current market with a dual time horizon – acknowledging a difficult environment over the next few weeks/months, but also an incredible long-run opportunity.

- We have performed a thesis review and verification on every mutual fund/ETF we hold in our purpose-based portfolios and we are pleased with what we own in client strategies. Relative performance has been strong relative to peer groups and benchmarks – we are confident we have a solid foundation in our portfolios.

- We are seeing many opportunities for higher potential future returns. For example, the spread in high yield bonds is currently 7.43%, implying interest rates in excess of 8% in some areas of the bond market. While we are looking for opportunities in both the stock and bond markets, “Credit” is a place we will look to play offense.

- We believe stock market leadership is currently found in large cap growth stocks and emerging market stocks, and plan to make sure exposures in our more growth-oriented strategies are tilted accordingly. Small cap stocks and value stocks appear to offer incredible relative value, but we are still watching for the catalysts for long-term leadership.

- Over the next few weeks, we plan to make “tax swaps” across our taxable accounts. For example, we may sell one large cap dividend growth fund and purchase another one to maintain the investment exposure, but reduce future tax liability. This is another way we can add value in a challenging environment.

Doing Something When Things Feel Out of Control

Matt Palmer and I had a great conversation yesterday about how people have the natural urge to do something when things feel out of control. It’s clear there are multiple of examples of people acting out of a spirit of fear including hoarding toilet paper and hand sanitizer. While proper preparation is essential, I’d encourage all of us to act out of a spirit of abundance. Let’s wash our hands, focus on relationships, and make a difference in the lives of others.