IRMAA – The Dreaded Annual Medicare Premium Adjustment

December 2, 2022

To Inform:

As we enter the end of the year, many people who are Social Security and Medicare age are receiving their notices about the changes for next year. The good news is that Social Security benefits are going up by 8.7% next year, which is one of the largest increases on record! The bad news is that for those with incomes above a certain threshold, some of this increase will be lost to the annual Medicare Income Related Monthly Adjustment Amount (IRMAA). It’s important to know how this annual adjustment works and how you can influence it so that you don’t pay too much in Medicare premiums.

What is IRMAA? How is it calculated?

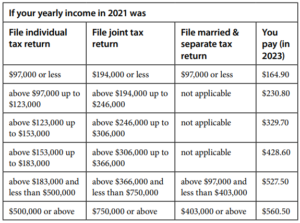

Most people will pay a standard Medicare premium in 2023 of $164.90/month if their income falls below a certain threshold. However, Medicare bases Part B and D premiums on income from two years prior, which means that your 2021 income determines your 2023 Medicare premiums. If your income is higher than certain thresholds (see below), then you will face an Income Related Monthly Adjustment Amount (IRMAA), which increases the amount you pay each month. If you are married and are both eligible for Medicare, this adjustment applies for both of you, which essentially doubles the adjustment amount – Ouch!

It’s important to understand where these income tiers occur to figure out whether this will affect you. Here is a chart of the 2023 Medicare Part B premiums based on income level:

Source: Medicare.gov

What can I do about higher Medicare premiums?

The first way to control Medicare premiums is to be aware of the ways that you can influence your income. Try to keep income down after the age of 63 (if you start Medicare at age 65) by maximizing pre-tax contributions to retirement plans, IRAs, HSAs, and other tax-deferred vehicles to reduce your income below one of these premium thresholds. Also, try to avoid unnecessary retirement account withdrawals that can drive your income up in retirement. Additionally, other income accelerating strategies like Roth conversions or IRA withdrawals become more expensive to execute when taking the higher Medicare premiums into account. Functionally, these premium increases act like an additional 1.5% tax per person (or 3% tax per couple), so make sure that the extra cost is worth it if you decide to accelerate income. Keeping an eye on your overall income after age 63 can help to avoid any unexpected surprises from Medicare.

Secondly, if you fall into the category of people who had income higher income while working, but now have lower income in retirement (or if your income has dropped significantly in retirement), then you can file an appeal to reduce your premiums. Medicare recognizes eight specific life-changing events that qualify for an appeal. Those eight events are:

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage (Retirement)

- Work Reduction (Partial-Retirement)

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment (if your employer went through bankruptcy or reorganization that caused your income to change)

How to file an appeal

You can file an IRMAA appeal by completing Form SSA-44. Many newly retired people over the age of 65 who begin Medicare immediately upon retirement will benefit from filing an IRMAA appeal, especially those people whose incomes were above the first Medicare premium thresholds ($97,000 for individuals and $194,000 for married filing jointly). Retirement is one of the most common life-changing events that qualify for a reduction of Medicare premiums.

Also, filing an appeal doesn’t cost anything, so if you can show that your income has declined, it may still be worth submitting an appeal, even if you don’t fall in one of the eight categories of life-changing events. The worst thing that can happen is that your appeal will be rejected, so it doesn’t hurt to try!

What happens if I do nothing?

The good news about the Medicare income adjustment is that it automatically resets every year based on your income from two years prior. So, if your income goes down in retirement, then your Medicare premiums will reflect this lower income two years later and automatically reset to a lower-level base on your new lower income. So, even if your IRMAA appeal is rejected, you are not permanently stuck with higher premiums. The key is to keep a close eye on your income going forward to avoid any more spikes in your premiums.

Conclusion

Don’t let high Medicare premiums catch you off guard! Pay attention to your income and where it falls in relation to the Medicare premium thresholds, especially after the age of 63. If you experience a drop in your income after becoming eligible for Medicare, you can potentially save yourself thousands of dollars in premiums by filing an IRMAA appeal. Complete the Form SSA-44 or reach out to your financial advisor or health insurance agent for help.

Written by Jake Martin, Client Advisor

Sources: Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event, Social Security Administration, 2020, www.ssa.gov/forms/ssa-44-ext.pdf., “Part B Costs.” gov, www.medicare.gov/your-medicare-costs/part-b-costs.