A Bright Future

December 16, 2022

To Inform:

This ‘To Inform’ article was originally published in the Fall 2022 issue of Harvest Magazine.

“It is always darkest just before the day dawneth.”

– Thomas Fuller

Optimism abounds for financial planners. No, we don’t have a crystal ball for where we might be headed, but it might surprise you to hear when we look at the retirement projections we build for our clients, our confidence level is near all-time highs. Let me explain.

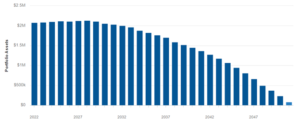

Below is a typical retirement graph.

Retirees have investable assets and spend those assets down (with the help of inflation) over some period of years (a 30-year time horizon in this example). There are many details behind this graph, but one key assumption is a 4% investment return. How reasonable is that 4% investment return? Let’s look at this from the perspective of the two components of total return:

Yield:

The 10-year U.S. Treasury is still considered one of the safest investments in the world, and it began the year yielding approximately 1.5%. As Travis Upton, our Chief Investment Officer, would say: “It’s tough to get 4% returns with 1.5% bonds.” Today as I write, the 10-year Treasury is yielding 3.5%-4.0%. That’s a big improvement in yield. In the short run, it certainly has hurt as bond prices have fallen, but longer-term, savers will be rewarded by clipping a higher interest coupon on their bonds. Not only will this pay off with higher yields, but it sets up the potential for price appreciation on bonds because at some point in the future the Fed is likely to cut rates and that should lead to bond price appreciation. Bond math is likely to work in investors’ favor.

Growth:

Pop quiz, which retiree was in better shape?

A. the one who retired in early 2008 when markets were near then all-time highs

B. the one who retired in early 2009 when markets were at a decade low

Answer: B. The person who retired in early 2008 thought he was sitting pretty, but history would tell us otherwise. He saw his portfolio cut in half and it took 3 years to rebound. That’s not a good equation when taking portfolio withdrawals. As for the 2009 retiree, he experienced one of the greatest bull markets in history and felt secure taking a monthly paycheck from his portfolio. Bottom line: forward-looking returns matter, and after major market pullbacks like what we’ve seen this year, we would expect future return assumptions to be even higher, giving us much more confidence in our return assumptions for retirement planning purposes.

As we consider the reasonableness of the retirement graph, my mind can’t help but reflect on our Provision Strategy. Designed to provide cash flow to our clients, Provision’s yield is now about 4%. Provision has had a strong relative performance year and those returns are likely to improve in the future as we realize the benefits of a higher yield and price appreciation as the market recovers. That’s a fantastic equation for retirement success.

So don’t let this year’s market correction cause you to lose your perspective on the bigger picture. As the 80’s hit song said, “The future’s so bright, I gotta wear shades.”

Written by Todd Walter, Partner and Chief Wealth Planning Officer