Nothing to Fear but Fear Itself

November 22, 2024

To Inform:

“We have nothing to fear but fear itself.” These words were spoken by President Franklin D. Roosevelt in his first inaugural address in 1933. Regardless of your thoughts on FDR (I have a few), these words were a salve to a nation wracked by economic turmoil and social unrest. Not a year earlier an “army” marched on Washington, D.C demanding early payment on their WWI service bonus certificates. Roosevelt’s words took time to have an effect, but a change in the nation’s psyche was at hand. As with many things, there are lessons we can learn from FDR’s speech that can be applied to investing. Let’s address a couple “fears” and how an investor might counteract them.

Fear of Missing Out (FOMO)

This one is a big one. Maybe a friend did great on a particular stock. Maybe you did as well but sold the same stock before it went meteoric. Perhaps you read an article about someone who risked it all – and won – on a highly speculative investment in a cryptocurrency. Whatever the case may be, there are myriad cases out there that can cause us to fear missing out. The worst reaction to these fears is to act on them. Morgan Housel, in his book The Psychology of Money, wrote, “Bubbles do their damage when long-term investors playing one game start taking their cues from those short-term traders playing another.” What Housel is saying is that those who sometimes are “king of the moment” are often playing a different game than the one we are. Changing the game we’re playing mid-stream can be ruinous.

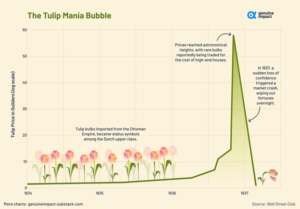

A great example of this is the story of the Dutch Tulip Bubble in the 17th century. At one point in the peak of the bubble it is said that a single tulip bulb was worth 10 times a craftsman’s annual income. A single Viceroy bulb was said to be worth, among other things, four fat oxen, eight fat swine, twelve fat sheep, two tons of butter, a half ton of cheese, and a silver drinking cup. Those who abandoned their “game” of steady wealth accumulation to play the “greater fool’s game” of buying and selling tulip bulbs were devastated. Isaac Newton, who would lose money in a later bubble said famously that he “could calculate the motions of heavenly bodies, but not the madness of the people.” If you find yourself experiencing FOMO ask yourself, “Is this the game I want to be playing?” If you cannot resist diving in, at the very least be thoughtful about how much you’re willing to risk playing a new game.

Source: LinkedIn

Fear of the Unknown

I had an advisor ask this week what potential landmines exist in today’s market. I responded by paraphrasing a favorite quote of mine spoken by Donald Rumsfeld years ago. There are known knowns, known unknowns, and unknown unknowns. What does this all mean? Well, in any market there are things we know. Right now, we know the state of the labor market (healthy). We know that inflation, while still above the Fed’s target, has been coming down. What about the “known unknowns”? While we know what is happening with inflation currently, we don’t know the path of future inflation as we go into 2025 with a new Presidential administration. We don’t know the impact or what even may transpire with tariffs. But we know these are issues. The unknown unknowns are completely invisible to us. No one knew 15 years ago that we’d be talking about data centers, bitcoin mining, and large language models today.

Is it worth worrying about these things? I would argue no. Because even if we know the answers to these knowns and unknowns, we still don’t know how the market will react to them. The Carson Group’s Chief Market Strategist Ryan Detrick wrote in a recent blog article that in some areas it pays to have a “glass half full” approach to life. He makes the case that markets are one of those areas. In his article, Detrick shared a chart the likes of which we’ve used in the past and probably one you’ve seen before. This chart tracks the price of the Dow Jones Industrial Average from 1900 through today. Peppered across the chart are several events, many known unknowns but even some unknown unknowns (Pandemic of 1919, Chernobyl, COVID-19). Markets largely advanced through these periods that were fraught with fear.

Source: Carson Group

Maybe you’re fearful of what the future holds. Perhaps you were “team blue” this election and you’re worried about the unknowns of a new administration. Perhaps you’ve read an article by someone who perhaps takes a more regular “glass half empty” view of the world. Regardless of how you feel, take some solace in the fact that we’ve been here before.

As we near the end of the year the calendar provides us time for reflection. If it is cathartic to reflect on some of the things you’re worried about, do it. But then spend some time following Detrick’s advice and thinking about the ways in which your plan and portfolio, perhaps even life in general are “half full”. Maybe you’ll be surprised, and maybe a little less fearful than when you started.

Written by Alex Durbin, CFA, Chief Investment Officer