Absolutely Positive, Relatively Frustrating

January 3, 2025

To Inform:

This Wealthnotes title, “Absolutely Positive, Relatively Frustrating,” reflects both returns and my mood as I look at markets to close out 2024.

Investment returns are often described as absolute or relative. Absolute simply means positive or negative, and in the absolute case, every major asset class posted positive returns in 2024 (although some just barely). Relative means compared to a benchmark or frame of reference. In the relative case, I think markets were frustrating. It “feels” like it was a fantastic year and that markets had a lift after the election… however, outside of a few big technology stocks posting out-size returns, the numbers don’t bear that out.

My mood is being influenced by the numbers. I’m absolutely positive because (with the caveat that every account is different) investors broadly achieved returns which exceeded estimates in financial plans. However, I’m also relatively frustrated because diversification and the end of the year didn’t turn out the way I would have hoped. Let me vent a few of my frustrations:

Santa Claus Didn’t Come to Town

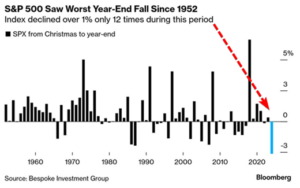

Usually, markets finish the year on a positive note, rising between Christmas and year-end in what is often referred to as a “Santa Claus rally.” In 2024, not only did Santa Claus not come to town, the S&P 500 posted the worst year-end decline since 1952, losing about 3% in the final week of the year. Yesterday I met with a client who said, “I checked my account before the holidays and my IRA was worth X…” Although the difference was not huge, I had to reset his expectations to a lower number as I showed him the final 12/31 numbers.

Source: Bloomberg

The “Trump Bump” Evaporated in the Final Weeks of the Year

In the days immediately after the Presidential election, markets rallied. Regardless of politics, Trump’s decisive victory removed a huge source of uncertainty for markets. However, after peaking in early December, most major asset classes gave back all of their gains and then some in the final weeks of the year. Most diversified asset allocations posted negative returns from election day through year-end.

Returns for Some Asset Classes Were Lackluster for 2024

In what feels like a rerun from 2023, market leadership in 2024 was concentrated within a handful of big technology stocks. Those tech stocks led the S&P 500 to post a return of over 24%. It’s a terrific number but with about 20% of the index in just three stocks, an analyst from Strategas recently quipped “the S&P 500 wouldn’t qualify as a diversified portfolio within most fund prospectuses.”

Other stocks and asset classes simply did not post the magnitude of returns the big technology stocks did. Here is a summary of a few asset class returns for 2024:

- High Quality Bonds (as measured by the Bloomberg Aggregate Bond Index): +1.36%

We remind investors the relationship between interest rates and bond prices often acts like two ends of a teeter-totter. When interest rates go up, bond prices go down (and vice-versa). Even though the Fed started cutting short term rates in September, longer-term interest rates, which are determined by the market, actually went up. The Fed cut short-term rates by a total of 1% from September 18th through the end of December, but the rate on the 10-year Treasury note moved up from 3.70% to 4.58% over the same period. Rates going up meant bond prices went down and the rise in rates subtracted about 4.6% from the total returns on bonds during the period.

Source: YCharts, Jerry Brown – TJG Global Investment Research

- Developed International Stocks (as measured by the MSCI EAFE Index): +3.43%

International stocks stink, right? Well, the story is a bit more complicated. Foreign stocks themselves were up about 13.7%, outperforming the average U.S. stock. The challenge lies in the fact that currency changes impact foreign stock returns. The value of the U.S. dollar soared in 2024, with much of the gain happening after the election. The rising dollar subtracted more than 10% from foreign stock index returns, resulting in a total return of over 3.4%.

What might this mean for foreign stock returns going forward? The dollar is widely expected to rise, much as it was in 2016 after Trump’s first election. If history is a guide, 2017 saw a sharp decline in the value of the dollar and was a year when the MSCI EAFE outperformed the S&P 500. We’re not giving up on foreign stocks yet.

- The average U.S. Stock (as measured by the equal weight S&P 500 Index): +12.77%

Didn’t we just say the S&P 500 was up over 24%? Yes, but in what will be a hot topic for the financial media in the months ahead, the S&P 500 is size-weighted and just 10 stocks make up close to 35% of the index, leaving 65% to the other 490 stocks. If we look at the same 500 stocks on an equally-weighted basis (which is a proxy for the average stock), we see a return of 12.77%.

I could provide further examples with real estate investment trusts, infrastructure, commodities, high yield bonds, all posting returns between +1% to +8%. When you put it all together, broadly diversified portfolios saw mid to high single digit returns for 2024.

I’m absolutely positive about 2024 with overall returns exceeding conservative assumptions within investor’s financial plans. Objective-based investors likely are exceeding their goals!

I’m also optimistic as I look at big picture themes which may drive 2025, such as one that I’m calling the “Irresistible Force Meets the Immovable Object.” Two of the most powerful forces in finance are “momentum” and “regression to the mean.” The last couple of years, we have seen momentum dominate through big technology stocks, but with valuations for these stocks looking expensive and valuations for other areas of the market appearing relatively cheap to a historic degree, regression to the mean would indicate a shift in leadership. Only one of these forces can prevail in 2025 – which do we think it could be? Tune into Portfolios at Your Place, for our annual “theme” event at 4pm on January 15th to find out and please invite a friend!

Happy New Year!

Written by Travis Upton, Partner and Chief Executive Officer