Investing Unconventionally – A Time for Health Care Stocks?

January 24, 2025

To Inform:

A question I like to ask money managers and market strategists is “what is your most contrarian opinion?” Howard Marks, the investor who helped pioneer junk bond investing and is one of the “rock stars” in the investment world, wrote, “If your behavior is conventional, you’re likely to get conventional results—either good or bad.” Now, being unconventional has its risks. It’s unpopular. It’s hard to do. And it feels a lot worse being wrong (i.e., losing money). Sometimes, it isn’t worth doing. That said, there are times where unconventional ideas are good ones and end up rewarding investors for their willingness to stand out from the crowd.

So, to flip the tables, I’ll imagine you are asking me, “Alex, what is your most contrarian opinion?” A few rattle around in my head, but one in particular is the outlook for health care stocks. I think there are opportunities ahead for this space if we can overlook some of the recent challenges.

Health care has not been a popular place to be investing in the last couple of years. In just the last two years, the price-to-earnings ratio (what investors are willing to pay for every dollar of earnings) of health care stocks has gone sideways. As you can see in the chart below, investors are paying 17 dollars in price for every 1 dollar in earnings generated by health care companies in the S&P 500. For the S&P 500 itself, investors are paying a little over 21 dollars for every 1 dollar in earnings generated by the 500 companies in the index. This has steadily risen from a little less than 17 at the beginning of 2023 when the broader market and the health care sector were trading at similar valuation levels.

Source: JPMorgan Asset Management

Health care stocks haven’t only struggled in the last couple of years. Over the course of the Biden administration, they were the worst performing sector in the S&P 500 (up just 38%) outside of real estate (up just 34%) while the S&P 500 itself was up around 80%. What led to this underperformance? A host of factors from rising rates (bad for biotech stocks) to negative headlines around reimbursement rates (bad for health insurance stocks) to the fading need for treatments for COVID-19 (bad for pharmaceutical companies but good for everyone else) all have weighed on the sector. Finally, a lack of innovation from many of the largest companies and a glum mergers and acquisitions environment has cast a pall on the sector.

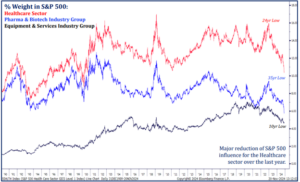

To the person looking for contrarian ideas, I’ve just listed a laundry list of reasons to explain why performance has struggled for this unloved sector. A mantra loved particularly by the contrarian, “it’s always darkest before the dawn” is the right one here. Health care stocks make up just over 10% of the S&P 500, a level lower than at any other point in the last 24 years. Pharmaceutical and biotech companies make up just 6% of the S&P 500, a level not seen in 35 years.

Source: Strategas

With such dour statistics as these, it doesn’t take a lot to turn around a sector. An improvement in deal-making and increased traction for new therapies for rare diseases or challenging societal problems like obesity could provide a boost for the sector. Simply meeting earnings expectations after a couple of years of negative revisions could be positive for the sector. Any easing of headlines from the incoming Trump administration could help with the negative sentiment affecting the sector. We once labeled health care a “bipartisan punching bag.” Now that the election is over perhaps health care stocks outperform the S&P 500, something they’ve done 70% of the time in the first year of a presidential administration going back to 1973.

Our CEO Travis Upton often says stocks respond more to “better/worse” than they do to “good/bad.” Health care stocks have indeed been bad because things have been trending “worse” for a while. At some point, expectations for health care reach a point where it isn’t very hard for news to be better than expected. When that happens history has shown time and again that that is the time when contrarian opinions provide good “unconventional” returns.

Written by Alex Durbin, CFA, Chief Investment Officer