Retirement Plans “Super” Catch-Up Contributions

January 28, 2025

To Inform:

Many of our clients, and all future retirees, could benefit from a provision of Secure Act 2.0 that will allow increased 401(k) contributions to a specific subset of retirement plan investors for the first time in 2025.

For several years now, retirement investors have been able to take advantage of catch-up contributions beginning in the year they reach 50 years of age. And for many of our clients, reaching age 50 was a welcome milestone as the increased contributions have a meaningful impact for retirement savings in the second half of their careers.

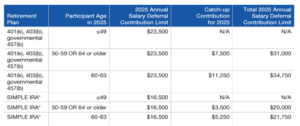

Beginning in 2025 401(k), 403(b), and governmental 457(b) retirement plan participants attaining the ages 60, 61, 62, or 63 during the calendar year can contribute an additional $3,750 beyond the standard age 50 catch-up contribution limit.

For SIMPLE IRA participants, the super catch-up contribution limit allows for an additional $1,750 in contributions at those same ages.

Similar to the standard catch-up contribution, the super catch-up contribution limit can adjust each year.

2025 Contribution Limits

The Internal Revenue Service provided a chart outlining allowed retirement plan contribution limits by type of plan and age for 2025.

*Of note, plan participants who reach 64 years of age at any point during the year will revert to the age 50 catch-up contribution limit for that year.

What’s Next for Eligible Participants

For plan participants who will be ages 60-63 at any point in 2025 and are interested in taking advantage of the super catch-up contribution, the first step is to check with your employer or retirement plan sponsor and confirm that your plan allows for these contributions.

Secure Act 2.0 created the provision that allowed for the super catch-up contributions within retirement plans, but employers and plan sponsors are not required to allow them.

If your retirement plan allows for the super catch-up contributions, it is worthwhile to ensure your retirement plan deferrals are correct and will capture the additional savings.

And of course, if you have questions regarding these super catch-up contributions, please do not hesitate to reach out to your team at The Joseph Group.

Written by Matt Zimmermann, CFP, Client Advisor