“This Is Not Going to Go the Way You Think…”

February 14, 2025

To Inform:

Many Star Wars fans, me included, think “The Last Jedi” (Episode 8) was a bad movie. At the end of “The Force Awakens” (Episode 7), Luke Skywalker came on the screen creating the anticipation that in the next movie, Jedi warrior Luke would be swinging his green lightsaber, saving the galaxy, and fulfilling the dreams of many Gen X youth. Instead, when The Last Jedi came out, Luke was a grumpy hermit who refused to use his lightsaber and caused Star Wars fans to collectively scream in agony. At one point in the movie, Luke says to young Rey, “This is not going to go the way you think…” which many believe was part of director Rian Johnson’s plan to troll the audience.

What does any of this have to do with investing? Sometimes, what seems obvious and what “should” happen isn’t the way things play out in reality.

Source: Tenor.com, from “Star Wars The Last Jedi”

So, let’s shift gears to market history and ask a multiple-choice question:

During President Trump’s first term (2017-2020), which of the following countries/regions had the best performing stock market?

- China

- United States

- Europe

If you said, 2, the United States, you would be WRONG! The correct answer is 1, China. What? In Trump’s first term, Chinese stocks performed better than U.S. stocks? Yes…just as it may seem to defy logic that Luke never used his green lightsaber in “The Last Jedi,” the MSCI China Index outperformed the S&P 500 during Trump’s first term.

Source: Dimensional Fund Advisors

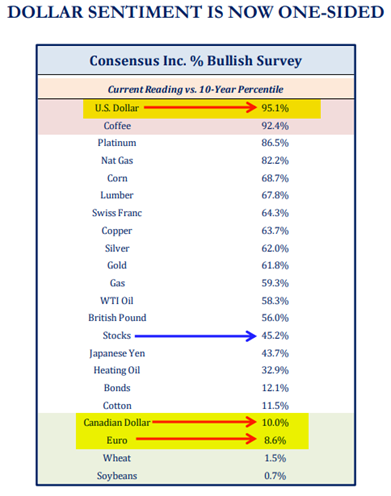

Today, as President Trump starts his second non-consecutive term as U.S. President, expectations are high for U.S. exceptionalism and a rising U.S. dollar. Sentiment survey data to start 2025 showed a 95.1% bullish view of the U.S. dollar. In other words, virtually everyone expects the dollar to rise, much as investors did during the start of Trump’s first term.

Source: Strategas Research Partners, highlights from The Joseph Group

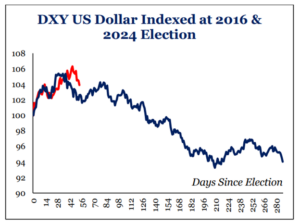

Again, it can be instructive to look at history and specifically what happened in 2016/2017, the first year of Trump’s first term. Back then, like now, expectations were high the polices Trump proposed to put in place would create a stronger dollar. The chart below shows today (red line) compared to what happened in 2016/2017 (blue line). The dollar strengthened immediately after the election, but then proceeded to weaken over the rest of 2017.

From an investment standpoint, the weaker dollar in 2017 supported foreign stocks, boosting their return for U.S. investors by about 8.5%, and pushing foreign stocks to outperform U.S. stocks.

Source: Strategas Research Partners

Fast forward to today. In calendar year 2024, foreign stocks (as measured by an index fund tracking the MSCI EAFE Index) had a terrible year relative to other asset classes, up only +3.5% for U.S. investors. When we do a little digging as to why, that +3.5% consisted of +13.7% from foreign stock returns (actually better than the average U.S. stock), but the rising dollar (particularly after the election) subtracted -10.2% from returns, resulting in a total return of only +3.5% for U.S. investors. In formula form, the 2024 return for the index fund tracking the MSCI EAFE can be expressed as:

3.5% Total Return = +13.7% stock return -10.2% rising dollar impact

As we start 2025, through February 13, an index fund tracking the S&P 500 is up +4.0%, while funds tracking the MSCI EAFE and MSCI Emerging Markets Indexes are up +8.2% and +5.4% respectively. In other words, foreign stocks are outperforming U.S. stocks to start 2025. And, if the consensus view on the U.S. dollar proves to be wrong, like it was in 2017, that performance gap could get even bigger as a weaker dollar translates to higher foreign stock returns for U.S. investors. If this plays out, despite disappointing returns in 2024, it is NOT time for investors to abandon foreign stocks.

We believe the lesson here for savvy investors is not to get too attached to what “should” happen. We’ve seen it in a galaxy far, far away as well as here at home – sometimes things do not go the way we think.

Written by Travis Upton, Partner and Chief Executive Officer