Making Diversification Great Again

March 7, 2025

To Inform:

The last couple of weeks have been a rude wakeup call for market participants. After touching an all-time high on February 19th, the S&P 500 through this past Thursday’s close was 6.6% off the recent high. Before getting to the why and what we’re thinking about it, let’s examine the selloff in the context of history. The chart below shows the last 45 years of S&P 500 returns with the gray bar indicating S&P 500 calendar year performance and the red dot indicating each year’s maximum decline within the calendar year. While there are some big outliers (1987, early 2000s, 2008, 2020) there are a host of years where markets have fallen as much as 10-20%. In many of these cases, the economy wasn’t even in recession.

Source: JPMorgan Asset Management

What has changed since the S&P 500 made its recent high? Backward looking economic data looks relatively decent. S&P 500 earnings were up, year over year, by over 15% in Q4 and came in ahead of analyst expectations. And while it is true that the labor market is showing some pockets of weakness, particularly in government jobs, it continues to expand: data released this morning shows the US employers added 151,000 jobs in February. Earlier this week, reports from the Institute for Supply Management showed both the services and manufacturing sectors of the economy in expansion. Other indicators, including employment, industrial production, personal income, and manufacturing & trade sales don’t look to be rolling over.

Source: Strategas

The market, however, is every bit as much a forecasting tool as it is a scorecard of recent economic and corporate news. And the market isn’t sure what to forecast. In Donald Rumsfeld speak, the market is confronting “unknown unknowns.” “Known unknowns” are typical in the market. No one knows what earnings will be next quarter, but we’ve always known that. What the market doesn’t know how to handle is the rise in uncertainty over the last several weeks. Depending on the day, we’re either seeing a massive increase in tariffs on trading partners in Mexico and Canada or we’re not. Automobiles may be exempted. Maybe not. Regardless your politics, this sort of uncertainty is not a positive for stocks. So, despite still decent economic news, the market is erring on the side of caution and in effect saying, “I’m not paying that much for earnings (the multiple on the market) when I don’t know what tomorrow brings.”

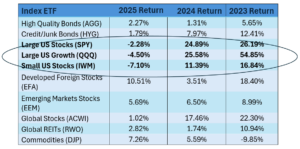

Thankfully, there are ways to invest within this framework. For much of the last couple of years, the S&P 500 has felt like the only game in town. The table below shows the returns of several market index ETFs in calendar years 2023 and 2024 as well as YTD 2025. Investors in diversified portfolios, particularly after 2024 were left asking, “Should I just be invested in US large cap stocks?” A pickup in volatility in 2025 coupled with tectonic global shifts in trade and geopolitics have reintroduced the benefits of diversification to a market that was beginning to doubt its merits.

Source: The Joseph Group Global Investment Research

As we always like to say, “trees don’t grow to the sky.” Staying the course with a diversified portfolio is best done when one assumes markets aren’t going to continue moving the same direction forever. A diversified portfolio is never the most exciting thing to talk about. At times it can be frustrating, especially when returns are being captured by just a narrow segment of the market. In times of volatility, we often encourage clients to think about their plan. The vast majority of client meetings I have the privilege to sit in on shows client plans work very well with conservative return forecasts (nowhere close to the returns we saw in 2024 and 2023!). We feel comfortable making these return forecasts because of the diversified nature of the investment portfolios we manage. As with every past period of uncertainty and volatility, this too shall pass. Hopefully, the benefit of a diversified portfolio makes it just a little easier to ignore the headlines and uncertainty in the meantime.

Written by Alex Durbin, CFA, Chief Investment Officer