The Dollar, Gold, and the Art of Taking Profits

April 17, 2025

To Inform:

Along with questions about tariffs in recent weeks, other topics of conversation have been around what is happening with the dollar as well as the move in gold prices to all-time highs. I’m going to address these and answer the question, “when should I take profits?” I cover a lot of ground here so if you only want to read about gold, skip to the bottom!

Let’s start with the dollar. It’s weakened so far this year. Many people hear the words “weakening dollar” and assume the worst. Let’s start though by clarifying the question. What is the dollar weakening in relation to? Is a weaker dollar bad for investors?

A good way to measure the weakening dollar’s impact on investors is to compare two ETFs that track the MSCI EAFE Index, an index of stocks in developed countries excluding the US. One of the ETFs “hedges” against currency movements so investors in the ETF get returns matching what the actual stocks in the ETF have generated in their own currencies. The other ETF holds the same stocks but doesn’t hedge against currency movements. The hedged ETF is down 2.24% in 2025 while the unhedged version is up 6.11%. A weakening dollar in this case has benefited investors.

The greater question, I think, isn’t centered on what the dollar is doing relative to other currencies but rather the dollar’s status as a global reserve currency. Is the dollar’s recent weakness presaging a global sea change in the role of the dollar? We don’t think so. One reason we believe this is that the currencies many look to as supplanting the dollar have serious issues of their own. For example, the Chinese Yuan is subject to very tight capital controls, making it a non-contender in the fight for global reserve currency status.

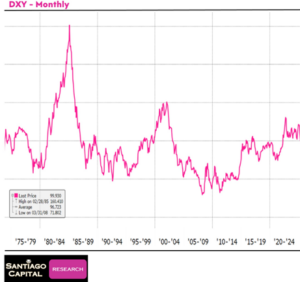

The other reason is that we’ve been here before, and history is a wonderful teacher. The chart below shows the US Dollar Index since the mid-1970s. The 1980s spike in the dollar led to a wide trade deficit. This was addressed at the Plaza Accord in 1985, and the dollar swiftly fell. The trade deficit narrowed, and the dollar remained the global reserve currency.

Source: X.com

Discussion about the dollar often occurs in tandem with what is happening to gold. Gold is up around 25% in 2025 after a banner year in 2024. What’s happening?

We’ve written before about the demand drivers for gold. Aside from its demand for jewelry and industrial uses, gold has robust investment demand. Private individuals and governments view gold as a store of value, a hedge against inflation, and a “flight to safety” asset. This investment demand, measured by the World Gold Council totaled 1,180 tons in 2024, with demand in Q4 at 344 tons, a 32% increase year-over-year. Central banks account for a large part of this. The following chart from the World Gold Council shows net central bank purchases of gold since 2010. Since 2022, central banks have been increasingly focused on owning gold for the reasons cited above and have shown little interest in slowing their purchases despite record high prices.

Source: World Gold Council

In many client accounts we have the privilege of managing, the Joseph Group added gold in 2022. We’ve trimmed this position in gold over the years, “taking profits” as gold prices have gone up. What are the kinds of things we look for to consider trimming an investment that’s been on a strong performance run? One thing is short-term momentum. A way to measure this is to look at the 200-day moving average price (the average price of an asset over the last 200 days) and see just how far away the current price is from the 200-day moving average price. Through yesterday, gold was priced 24% above its 200-day moving average price. This premium is higher than 98.5% of all daily observations since 1980. We like gold for a lot of reasons the rest of the market does, but that kind of near-term momentum in gold has us pondering another round of “profit taking trims.”

We know there’s a lot going on in the world, and we take seriously our responsibility to try and get a sense of what is happening and what this means for markets. Hopefully you know a little more about the dollar, gold, and when to take profits than you did before reading this. If you still have questions, join us next Wednesday at 4:00 PM on Zoom for our April “Portfolios at Your Place” where Travis and I discuss the first 100 days of the Trump administration and what we’re seeing and doing as it relates to markets.

Written by Alex Durbin, CFA, Chief Investment Officer