Investing Like Rip Van Winkle

July 25, 2025

To Inform:

Summer and country music (the good stuff, mind you) go hand in hand. Now I know I’ve used these pages before to express my love for country music, so if you’ll indulge me, I’m going to do it again. I recently wrote a commentary for our 401(k) plan clients that reminded me of a line from the 1982 hit from Alabama “Mountain Music.” The boys from Fort Payne, Alabama sang about the old days where they could “nap like Rip Van Winkle.” In the hustle and bustle of life not many of us get a good nap anymore. The “I’ll sleep when I’m dead” mentality is a hard one to shake, and if that’s your motto I don’t think I can convince you otherwise. That said, let’s at least ponder the potential of napping like Rip Van Winkle when it comes to our investment portfolios.

Jason Zweig, a long-time columnist for the Wall Street Journal wrote an article years ago about the “Rip Van Winkle Portfolio.” Zweig, a more erudite fellow, went straight to the source – Washington Irving’s short story about a Dutchman who takes a 20 year nap in the Catskills. The article I wrote for our 401(k) plan clients highlighted how in even the second quarter, the person who “slept through” the volatility of early April did well compared to the person who panicked and sold in the depths of the early April selloff. To put it into numbers, a person that sold US stocks in the depths of the selloff would need a gain of 23% just to match the person who didn’t do anything in the quarter.

This is just one quarter we’re talking about. But what about even longer periods? In Zweig’s piece he highlighted a contest put on by the pension system of a British university. The contest asked participants to imagine how they might invest for a time horizon measured in decades instead of days. Zweig makes the point that multiple participants stated that the purpose of a pension plan is not to outperform the market or its competitors (goals which can easily lead to poor decision making). Instead, the goal is to cover its liabilities – by ensuring that retirees get the benefits they will need to live on. To do that, one must think in decades.

In the world of private wealth management, we typically aren’t managing pension assets. But the liabilities of the clients we have the privilege of serving are not altogether different than the liabilities of a large pension system. When we begin to think through that lens, unique things begin to happen.

One of the most important things that happens is that it changes the way we react to volatility in markets. In Zweig’s piece he refers to Benjamin Graham, the legendary value investor whose brightest pupil was Warren Buffett. Graham once said that “the investor who permits himself to be stampeded or unduly worried by unjustified market declines in his holdings is perversely transforming his basic advantage into a basic disadvantage.”

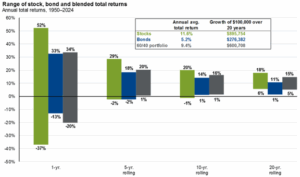

This basic advantage is time. The chart below from JPMorgan highlights this “basic advantage” by showing the range of returns over 1, 5, 10, and 20-year rolling periods for US stocks and bonds. The range of returns in the 1-year timeframe ranges from +52% to -37% for stocks and +33% to -13% for bonds. When we zoom out, however, the range of returns begins to tighten. Instead of an 89% swing for stocks in the 1-year period, that number shrinks to a range of 31% in the 5-year rolling period, 19% in the 10-year, and just 12% in the rolling 20-year period.

Source: JPMorgan Asset Management

The “Rip Van Winkle” investor who has the benefit of time and the one who diversifies their portfolio by not owning just US stocks and bonds benefits from two of the limited “free lunches” when it comes to investing, time and diversification. When looking at the chart above, it becomes clear that patience, historically, has benefited investors. While an 18% annualized return in stocks for 20 years would be fantastic, could we still meet our goals with 6% annualized returns? A lot of us can, but we have to ride out the ups and downs on the way.

Markets can be mystifying, stressful, and exciting. Sometimes all in one day. Our best advice for cutting through all that noise is to take more of a Rip Van Winkle approach. Rip Van Winkle was quite surprised when he woke up. We aim to be more intentional than that, but the idea is the same. Invest for your long-term goals and let the market do what it does. With enough time, we think those are keys to success.

Written by Alex Durbin, CFP, Chief Investment Officer