Three Key Points from Portfolios at Your Place

August 15, 2025

To Inform:

Earlier this week, Joseph Group Chief Investment Officer, Alex Durbin, and I had the opportunity to talk to a group of clients and friends about what we are seeing in markets in our quarterly Portfolios at Your Place Zoom event.

We set the stage talking about the current landscape:

- U.S. stock market indexes hitting all-time highs

- Tariffs remaining in the headlines, but showing little current impact on inflation data

- Labor market showing signs of slowing

- Market pricing in about a 90% chance of the Fed cutting rates at the September meeting

From there, we covered a lot of ground, but here are three key charts we discussed and their implications:

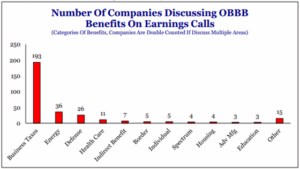

Corporate Tax Benefits from Recent Tax Bill

The chart below looks at categories of benefits from the “One Big Beautiful Bill” (OBBB) tax package recently passed. By far, the biggest benefit discussed on corporate earnings calls was a reduction in business taxes. The ability for companies to immediately expense research and development and infrastructure expenditures should result in lower corporate taxes and in turn higher free cash flows for companies across multiple industries.

Source: Strategas Research Partners

Bottom line: Tax benefits from the recent tax bill provides a positive tail wind and fundamental support for stock prices.

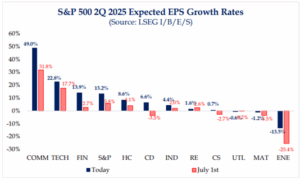

2nd Quarter Earnings Coming in Better than Projected

Don’t worry too much about the details in the chart below. The key is the blue bars are higher than the red bars virtually across the board. What this means is 2nd quarter earnings growth is coming in significantly higher than what was expected at the beginning of July. For the S&P 500, on July 1, earnings growth was expected to be about 5.8% but is coming in closer to 13.2%.

Source: Strategas Research Partners

Bottom line: We like to remind investors the market responds more to “better or worse” than “good or bad.” Earnings coming in “better” than what was expected six weeks ago provides fundamental support for stock prices.

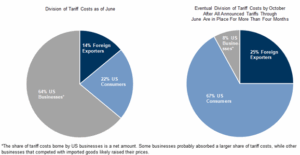

Tariff Impact Shifting Later This Year?

The first two charts were good news for stocks, but this one is admittedly more of a mixed bag. Goldman Sachs recently put out a research report showing as of June, most tariff costs (64%) have effectively been borne by U.S. businesses. However, in the months ahead, Goldman believes the tariff cost burden will shift with U.S. consumers starting to bear the brunt of the costs (67%), likely through higher prices.

Source: Goldman Sachs Asset Management

Bottom line: Tough to say. Consumers bearing more of the tariff burden through higher prices could help profit margins and stock prices, but also could ignite inflation fears, which in turn could slow potential rate cuts. Shifting tariff impacts are a big thing to watch in the months ahead.

Every quarter we seek to proactively keep clients and friends informed of what we are seeing in markets (and most importantly how that impacts portfolios) through an online Portfolios at Your Place event and an in-person Portfolios and Pints event. Thank you to everyone who joined us at our quarterly online event this past Wednesday. Our next in-person event has become an annual tradition, and we are excited to invite you to our kickoff to Octoberfest with Portfolios and Pints on September 10th at the Hofbrauhaus in Columbus. Alex and I will be pulling questions out of the German hat, and it is sure to be entertaining. We hope you can come and please feel free to bring a friend!

Written by Travis Upton, Partner and CEO