Today’s Job Market and the Federal Reserve

September 5, 2025

To Inform:

A favorite activity at my home is when dad throws batting practice to the boys, when I can find the strike zone, that is. When the kids are feeling cheeky (and maybe my pitches are a little wild) they like to toss back more than one ball at once. Usually, I try to focus on one ball and even then, it’s hard to catch. Trying to snag both is nearly impossible. Focusing on two things at once is something few of us master, but something the Federal Reserve is tasked with by Congressional directive.

The Fed is tasked with two mandates: maintain price stability and maximize employment through monetary policy. Often, and as has been the case for much of the last 25 years, these mandates have been simple to balance. If unemployment is high, lower policy rates to stimulate the economy. If unemployment is low and inflation is a concern, raise rates just enough such that price pressures remain under control yet people keep their jobs.

In the post-COVID era, this mandate has been harder to balance. Inflation pressures coming from such varied sources as supply chain disruptions and shelter inflation have scarred the Fed. It wasn’t that long ago they were almost yearning for more inflation! Lately, however, they’ve been laser-focused on ensuring that a “second wave” of inflation does not materialize. While that is an admirable goal, the risk of focusing too much on inflation is that economic conditions, through higher Fed funds rates, begin to weaken. A weakening economy results in slowing jobs growth and could lead to job losses.

Where are we today? While the Fed has intimated that rates are going to be cut later this month, we think the focus on inflation has been too narrow and that a deteriorating labor market demands the Fed’s full attention.

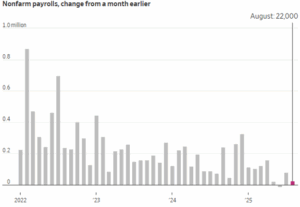

In the most recent labor report released today, the Bureau of Labor Statistics (BLS) reported that just 22,000 jobs were created in August, with the unemployment rate ticking up to 4.3%. Revisions to prior months’ figures were again negative, with June actually showing a loss of 13,000 jobs, the first negative month for jobs growth since 2020.

Source: The Wall Street Journal

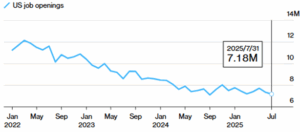

Elsewhere, the BLS’s monthly report of job openings shows demand for labor is somewhat tepid, with around 7.2 million job openings back to yearly lows seen last summer, and well off the post-COVID boom of over 12 million job openings.

Source: Bloomberg

Taken together, these figures may be concerning, but do not warrant DEFCON-1 status. Job openings peaked at 7.5 million in the years leading up to COVID and stood at just over 5 million prior to the Financial Crisis. The post-COVID spike was an anomaly not likely to be repeated.

What these figures do show us is that jobs should be a bigger concern to the Fed than inflation. While inflation is above the Fed’s target, it is trending in the right direction. The market is coming around to this view, with futures pricing showing nearly 100% odds of a cut to the Fed Funds rate in September. We’ll get one more inflation report before then, but our view is that this isn’t likely to change the Fed’s path. By December, the market is pricing in 70% odds of 3 quarter point cuts to the Fed Funds rate, up from just 40% odds one week ago.

The market response in stocks and bonds, as of the time of this writing, is one of slight concern. Interest rates are down, which is good for bond prices but reflects lower growth expectations. The stock market is oscillating between red and green as investors focus their attention on the risks of further labor market deterioration. Mid-cycle labor market slowdowns like this are manageable, as long as the Fed keeps their eye on the right ball. We believe the Fed can safely ignore the inflation ball in the air, as the one more likely to clock them in the nose is the employment ball. The rest of 2025 will show us how well they can do that!

Written by Alex Durbin, CFA, Chief Investment Officer