What’s Next for Fed Rate Cuts?

September 19, 2025

To Inform:

Earlier this week the Federal Reserve (in surprise to virtually no one) cut interest rates by 0.25%, taking the upper band of the Fed Funds range from 4.50% down to 4.25%. The Fed Funds rate influences short-term interest rates for things like money market funds so cash savers should expect to see lower rates in the days ahead.

One of the big questions we are getting from clients – “Are we going to get more Fed rate cuts in the months ahead?” Let’s look at the data.

One of the best sources of information about what the Fed may do next comes from CME FedWatch:

The tool, which comes from the Chicago Mercantile Exchange, looks at the market for Fed Funds Futures and provides percentage odds of what the Fed may do at their upcoming meetings.

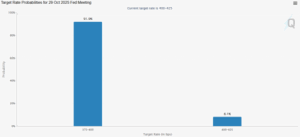

The Fed’s next meeting happens on October 29, and the market is currently pricing in 91.9% odds the Fed will cut another 0.25%, taking the upper band of the Fed Funds Rate down to 4%.

Source: CME FedWatch as of 9/19/2025

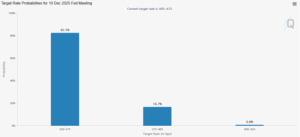

The Fed’s final meeting in 2025 takes place on December 10th. The market is currently pricing in 82.5% odds of a second 0.25% rate cut, taking the upper band of the Fed funds rate down to 3.75% by the end of 2025.

Source: CME FedWatch as of 9/19/2025

What about 2026? The picture gets murkier the further you go out, but by next July the market is putting the highest odds on the upper band of the Fed funds rate being at 3.25%. The rate was 4.50% at the start of this week, so that would imply a total of five 0.25% rate cuts, or a total 1.25%, being priced in for the middle of next year. The bottom line – the market is looking for lower interest rates.

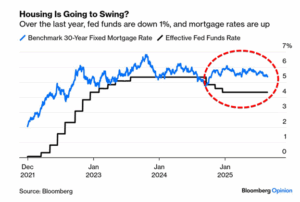

A question we are getting from clients – “Do Fed rate cuts mean we will see lower mortgage rates ahead?” The answer to that question is, not necessarily.

If there is one point you should take away from this WealthNotes it’s this: the Fed control very short-term interest rates, but mortgage rates are typically influenced by the 10-year Treasury bond rate.

The 10-year Treasury rate is controlled by the market and may move independently of what is happening with the Fed. We saw an example of this in late 2024 (see chart below). Even though Jerome Powell and the Fed cut short-term interest rates, the rate on the 10-year Treasury rose during that time period which coincided with an increase in mortgage rates.

Source: Bloomberg

Looking at the last few days, we’ve seen the 10-year Treasury (and in turn mortgage rates) move independently of the Fed. At the start of September, the 10-year Treasury rate was about 4.27%, and moved down to 4.01% around the time of last week’s weaker than expected jobs report but has moved back to 4.14% as I am typing.

Barring a major shift in economic data, we are likely to see more Fed rate cuts in the months ahead, which likely means lower savings rates on vehicles like money market funds. For those looking for lower mortgage rates, Fed rate cuts may or may not be helpful. Keep an eye on the direction of the 10-year Treasury rate (currently 4.14%) – that’s the key number to watch.

Written by Travis Upton, Partner and CEO