How Might the Government Shutdown Effect Markets?

October 3, 2025

To Inform:

When considering what to write about, my mind often turns to what is in the headlines. No one wants to hear about how the Cleveland Guardians overcame a 15.5 game deficit against the Tigers to win the American League Central Division on Sunday only to be bounced from the playoffs by the same Tigers team four days later. Similarly, very few of us want to hear about another government shutdown in Washington, D.C., but we feel like we should be informed. So, what does the current game of “Chicken” in Washington, D.C. mean for markets in the near-term? Very little. In the medium term? Potentially a lot more.

Government shutdowns are not new, but it can be easy to forget how and why they happen. Congress is required to pass an appropriations bill in advance of the start of a new fiscal year, which begins on October 1. Historically, the Legislature is not very good at meeting the deadline. Since 1999, in only one year (1999) Congress was able to pass a funding bill in less than 50 days after the deadline. In some years, Congress has failed to pass a bill for six months. To get around this, compromises are made, and “Continuing Resolutions” are passed to give Congress more time to get a bill across the goal line. Shutdowns occur when the government fails to pass an appropriations bill and fails to pass a continuing resolution.

We won’t get into the politics as to why the government has failed to pass either a bill or continuing resolution. The fact is, Congress is at loggerheads so that means all “non-essential” government services are suspended. Essential services that still operate include air traffic control, law enforcement and public safety, military activity, the postal service, and all mandatory spending programs (Social Security, Medicare).

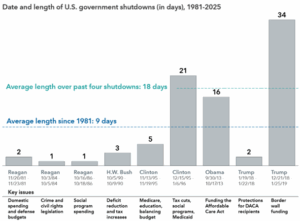

Perhaps it is the fact that essential services continue uninterrupted or the fact that the average shutdown lasts just 9 days as the chart below indicates, either way shutdowns simply don’t have much of an impact on markets. Government bond yields in the US are down over the last 5 days. The S&P 500 is ahead modestly this week and Friday at noontime is trading at all-time highs. All of this is consistent with historical evidence that shows shutdowns tend not to rattle markets.

Source: Capital Group

All that being said, the risks with this shutdown would argue that the longer it goes on, perhaps markets could get turbulent. One of the biggest reasons why the market could be more vulnerable the longer the shutdown goes on is that markets remain very focused on two key data points – jobs and inflation data – both of which are murkier when the government is shut down.

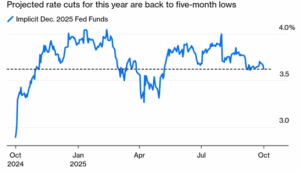

The chart below from Bloomberg shows that the projected number of rate cuts by year end is back at five-month lows. This is generally good news for the stock market, particularly for companies that would benefit from a decrease in rates. If, however, the Fed chooses a course of inaction because monthly jobs and inflation data is delayed or stale, it is possible markets get fewer cuts by year end than expected. This could pressure stock markets and may also pose a risk for bond investors were rates to tick up.

Source: Bloomberg

Our base case is not for a lengthy government shutdown, but we want to be aware of the possibilities. Whatever the outcome, it is situations like this that increase our confidence in the objectives-based investment approach we take at The Joseph Group. For those with investment objectives shorter-term in nature (e.g., monthly cash flow, a spending need in the near future) our strategies designed to deliver on those objectives are allocated across asset classes in such a way that volatility related to a government shutdown is likely to be manageable. For those with investment objectives longer-term in nature, any volatility that may come because of this shutdown could be a buying opportunity.

Written by Alex Durbin,CFA, Chief Investment Officer