Beware Pessimism in Investing

October 31, 2025

To Inform:

Over the past week I’ve had several conversations with clients, colleagues, prospects, all of them getting at a question that seems to be on everyone’s mind – how sustainable is the market recovery? In one of these conversations, we talked about tariffs and how they haven’t yet had the impact people were expecting. Others have wondered about the implications of huge spending on AI and data centers in the US and how durable that is. Still others have said that they thought months ago that surely the US would be in recession by now given all of the geopolitical tensions we’ve witnessed.

These questions are valid. It is in our nature to think about risks. In Morgan Housel’s The Psychology of Money an entire chapter is dedicated to “The Seduction of Pessimism.” Why is pessimism appealing? Housel believes it is because pessimism sounds smarter. Ned Davis, a well-known Wall Street researcher once described it this way: “Bears sound smart, bulls make money.” Bulls generally are optimists. But what is optimism? Housel clarifies a difference between blind, excessive optimism (complacency) and true optimism, saying “Optimism is a belief that the odds of a good outcome are in your favor over time, even when there will be setbacks along the way.”

One of the dangers of pessimism that Housel highlights in his book is that those who often succumb to it tend to extrapolate current trends, failing to consider how companies or markets might adapt. Housel cites what happened in oil markets in the mid-2000s. Pessimists saw no end in sight to the rise in the price of oil. Cue the oil shale revolution and here we are nearly 20 years later with oil prices a fraction of the peak they hit in 2008.

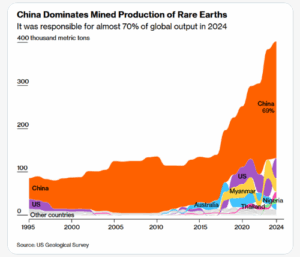

What might pessimists be extrapolating today? Recently China made headlines when their Ministry of Commerce implemented more stringent export controls on rare earth metals. While the global reaction was swift and the Chinese have backpedaled some, pessimists point to the very concerning fact that China mines close to 70% of rare earth metals as seen in the chart below. China doesn’t totally control global reserves; they simply have cornered the market on processing, where they control over 90% of the market. The Chinese have been able to do this because other countries have strict environmental controls that make it difficult to process rare earth metals.

Source: X.com

In this situation it is obvious that if the pessimistic view is right, this will have major impacts on the global economy. But, the optimist will say we live in world where countries and companies adapt. We’re already seeing hints of that happening. Researchers at the University of Texas in Austin recently published research that, if scalable, could result in a much cleaner method of extracting rare earth metals and thereby allow countries that have given up on such work to begin doing it again. It is this sort of adaptation, I think, that is why pessimists (sometimes myself included!) often see their fears never materialize. If enough people are committed to solving a problem, which is what optimists do, often they’ll solve the problem.

Whether you’re a pessimist, an optimist, or somewhere in the middle, this time of year is a great time to sit down and review your goals and objectives and ensure your financial picture is in line with what you want to achieve. We’ve found that for the clients we have the privilege of serving, a proactive review of goals and objectives and how all the pieces fit together on your Storyboard is a great way to avoid some of the excesses that optimists fall victim to while also avoiding the seduction of pessimism.

Written by Alex Durbin, CFA, Chief Investment Officer