Investing in a K-Shaped Stock Market

January 16, 2026

To Inform:

Earlier this week The Joseph Group’s CEO Travis Upton and I conducted what has become a tradition – our annual “themes outlook” Portfolios at Your Place event. Travis regularly likes to cite one of the famous quotes from the late founder of The Leuthold Group, Steve Leuthold. Around this time of year, Steve was known to say, “forecasts are for show, portfolio changes are for dough.” In other words, Steve was saying that it is one thing to make a forecast, it’s another to identify investment themes that could be relevant in the year ahead and talk about what one is doing in portfolios in response to those themes.

A number of themes we discussed this week have been expounded on in prior WealthnNotes, but an important one we discussed that I want to highlight is the idea of “K-shaped” markets. The phrase “K-shape” was popularized after COVID by economists who looked at the spending habits of US consumers and identified that high income consumers were doing well and pumping up retail sales. Lower income consumers were struggling and if you could graph these two groups’ diverging fortunes, you got what looked like the letter K.

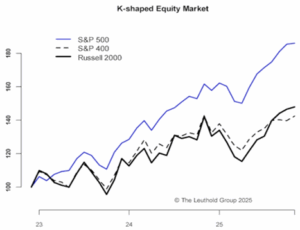

While that phenomenon continues in the economy with households, we’ve also identified it in markets. The chart below from The Leuthold Group isn’t perfectly K-shaped, but the principle is evident that the S&P 500, led by the oft-cited “Magnificent 7” stocks has done quite well the last few years. Just as lower income households have experienced some degree of financial stress in recent years, a host of companies in the market (mid cap and small cap stocks) haven’t done as well as the well-heeled mega cap stocks in the S&P 500.

Source: Leuthold Group

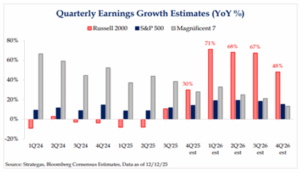

What’s different about stocks and consumers, however, is that eventually the law of large numbers makes it hard for the leaders of yesterday to continue to lead into the future. Why is this the case? Well, when we look at the chart below one of the things that sticks out is that earnings growth in the S&P 500 has been strong in recent years and is even expected to pick up in 2026. But note the trend in earnings growth in the “Magnificent 7” stocks, represented by the gray bars. Earnings growth that occurred at a blistering pace in 2024 and 2025 has begun to trend downward. It is quite hard for a group of stocks, no matter how magnificent, to grow earnings at >50% rates ad infinitum.

Source: Strategas

What excites us about this is that if earnings growth can pick up in areas of the market analysts currently expect it to, that bodes well for the parts of the market that have been “left behind” in recent years. The chart above not only shows a surge in analysts’ expectations of earnings growth for small companies, but it also implies that mid and large cap stocks outside the largest companies in the S&P 500 could also see earnings pick up.

We’ve been positioned for this in the client accounts we have the privilege of managing. While we will happily allocate money to some of the market’s biggest companies, we’ve also allocated dollars toward strategies that would benefit from a broadening out in earnings growth in the year ahead.

I had an old boss that was fond of saying “everything’s cyclical” and that the market “comes around goes around.” We’ve seen hints of this in recent weeks as small cap stocks and actively managed strategies invested in things other than the “Magnificent 7” have been quietly outperforming. This theme is one we think may have staying power in 2026.

Written by Alex Durbin, CFA, Chief Investment Officer