A Conversation With a Fund Manager About Banks

August 29, 2025

To Inform:

One of the greatest benefits of working at The Joseph Group for a person in my seat is the opportunity to get face time with the portfolio managers we’ve entrusted with the responsibility of managing our client’s capital. This past week, Senior Investment Analyst Jerry Brown and I had a conversation with a portfolio management team that manages a long/short stock portfolio. Long/short managers sell short stocks they think will struggle and buy stocks they think have more attractive return prospects.

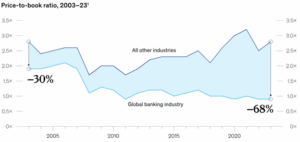

One major emphasis on our call was the team’s view on banks. They expressed a belief that ever since the Great Financial Crisis of 2007-2009, bank stocks have been viewed suspiciously by the market and have struggled to keep up with the performance of the rest of the market. The chart below from McKinsey & Company is slightly dated, but it is a story that is still true: bank valuations in general dropped after the financial crisis and have struggled to recover. The average price-to-book ratio (a measure of valuation) for global banks fell from close to 2.0 in the early 2000s, to around 1.0 in recent years.

Source: McKinsey & Company

At these valuations and with several potential catalysts on the horizon, the team is positive on banks. What are those catalysts? The portfolio managers discussed a normalizing yield curve, and a more favorable environment for merger and acquisitions as being potential tailwinds for the banking sector.

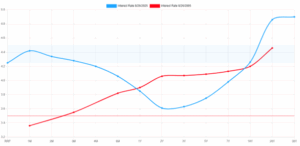

A normally sloped yield curve is one in which short-term interest rates are lower than long-term rates. The chart below shows what the yield curve looked like 20 years ago (red) and what the yield curve looks like today (blue). In a normally sloped yield curve environment, it is generally understood that banks can “borrow short” (take deposits and pay lower short term rates) and “lend long” (make loans at higher long term rates). This margin, when positive, contributes to bank earnings. With potential cuts to the Fed Funds rate on the horizon, the possibility of a normalized yield curve could be additive for banks.

Source: ustreasuryyieldcurve.com

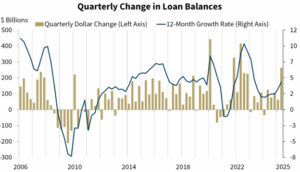

To make money on loans, however, banks must actually make loans. Loan growth is viewed positively if investors have confidence in the bank’s underwriting skills. Loan growth is viewed as being evidence of a healthy economy. When there is less demand for loans, the earnings potential for banks is less robust. As you can see in the chart below, loan growth typically falls in periods of economic weakness (2007-2009, 2020, 2022-2023).

Source: Federal Deposit Insurance Corporation

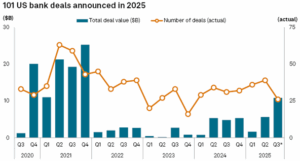

Bank mergers and acquisitions are often an opportunity for portfolio managers who are interested in owning smaller banks that are attractive to acquirers. After a surge during the first Trump administration, bank M&A activity tailed off beginning in 2022 and continuing through 2024.

Source: S&P Global

It’s a safe bet to say that this portfolio management team looks at banks as being a “value with a catalyst” opportunity. Simply put, bank valuations aren’t overly stretched and with the potential for a better operating environment, increased merger and acquisition activity, and regulatory relief (something I didn’t get into here), they are attractive to the managers of this fund. We ourselves have been interested in this space, with many client portfolios in our Abundance strategy holding a position in a financial sector ETF. It’s safe to say that our conversation affirmed our view here.

So much of this business is about building great relationships. We relish the opportunity to do this with our clients and look to invest with managers who are just as inclined. This gives us the opportunity to build confidence and understand the thinking of these portfolio managers. So many of these meetings end with an expression of gratitude – not only for our team’s trust in them, but for the opportunity they have in serving our clients.

Written by Alex Durbin, CFA, Chief Investment Officer