A Look at Contrarian Investing

May 7, 2021

To Inform:

I find great investment wisdom in reading from the accumulated wisdom of some of history’s greats. One such investor is David Dreman, author of Contrarian Investment Strategies. Dreman began investing in the late 1950s and ran his own firm for over 30 years. In his book, Dreman provides a number of “Rules”. One rule reads as follows: “Favored stocks underperform the market, while out-of-favor companies outperform the market, but the reappraisal often happens slowly, even glacially.”

This advice is indeed contrarian in nature, as it often seems the reasonable choice to invest in favored stocks and avoid those that fail to garner any investor interest. The reason for this is may seem unclear, but it’s really quite simple. Dreman posits that because favored stocks have high expectations any stumble can severely impact the share price. Out-of-favor stocks have very low expectations and negative surprises hardly register in the share price. Positive surprises or catalysts for out-of-favor stocks tend to be unexpected and often result in a “re-rating” of the stock, sending share prices higher.

We’re seeing this today across the market. Many of the stocks that dominated the market during the COVID shock are languishing and, in some cases, well off their recent highs. A good proxy for these stocks, often dubbed “stay at home stocks”, is the Russell Mid Cap Growth Index. The chart below shows how over recent months these former market stars are behaving a bit like duds. Are these “bad” companies? Not at all. They’re simply victims of their own success and perhaps unrealistic expectations from investors and analysts.

Source: Google Finance

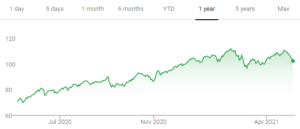

Conversely, owning out-of-favor stocks can generate significant returns. One recipe for success is finding stocks or sectors in which sentiment couldn’t be much worse and where there is some sort of potential positive catalyst. We’ve seen this over the past year in places like energy companies, banks, and homebuilders. Expectations for these types of companies couldn’t have been much worse, and a positive catalyst in the form of a COVID vaccine sent these stocks higher. A one-year chart of the Russell 2000 Value Index, where many of these types of companies are found, shows just how powerful this one-two punch of beaten down sentiment and a positive catalyst can be.

Source: Google Finance

We’re constantly evaluating the lineup of strategies and individual stocks we manage for clients through this lens. Our goal is not to be contrarian for contrarian’s sake, but to uncover opportunities where a contrarian view about a stock or a style of investing has a decent probability of success. This sounds easier than it is. The difficulty lies in overcoming the emotional impulse to chase what’s been working and avoid the areas of the market that everyone else is avoiding. History has shown, however, that those dark corners are sometimes where the very best opportunities might lie.

Written by Alex Durbin, Portfolio Manager