Asset Class Outlook Based on Fundamentals

May 26, 2016

Earlier today we held our monthly “Portfolios at Panera” event. The last Thursday of each month we spend an hour talking with clients and friends about what is happening in the markets and how those happenings are impacting client portfolios.

Today, in addition to talking about “hot topics” such as the British referendum to potentially leave the European Union (vote on June 23rd), and when the Fed might raise interest rates (July looks most likely as of today), we spent a good deal of time looking at forecasts of which asset classes are likely to have the best (and worst) performance over the next five years.

In April, The Blackrock Investment Institute released their “Capital Market Assumptions” with forecasts of returns and volatility for various asset classes over the next five years. Blackrock carries a lot of weight in the money management industry as they are the world’s largest asset manager with total assets of over $4.7 trillion dollars as of 2015 (source: Wikipedia.org). It is important to note these return and volatility assumptions are based on fundamental factors like growth rates, dividends, valuation, and inflation – they do NOT consider political or other factors which could impact returns. As a result, Blackrock is quick to point out (as are we) that estimates of future returns are not a recommendation and are for illustrative purposes only – they do NOT reflect estimates of what a client portfolio may achieve and do not reflect investment advice.

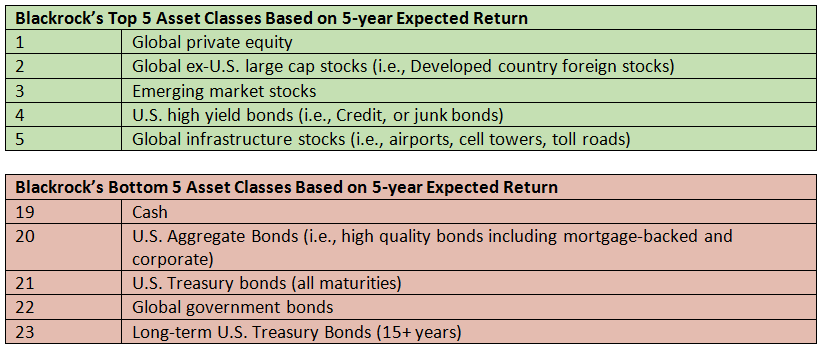

We cannot produce the entire Blackrock report here, but out of 23 different asset classes, here is a summary of the Top 5 and Bottom 5 asset classes based on Blackrock’s forecast of 5-year expected returns.

According to Blackrock’s estimates, the top 5 asset classes based on fundamentals have a forecasted return of 4.8% or better per year over the next five years while the bottom 5 asset classes have a return of 1.4% or less oer year.

Assuming Blackrock’s Capital Market Assumptions for the next 5 years have merit, what are implications for investment portfolios? Here are three key points we discussed this morning:

· It is important to look globally for investment opportunities. Four out of the top 5 categories on Blackrock’s list are foreign or international in nature, with U.S. stocks further down in the forecasted return ranking. One of the key reasons for the disparity is valuation – U.S. stocks are more expensive than foreign stocks.

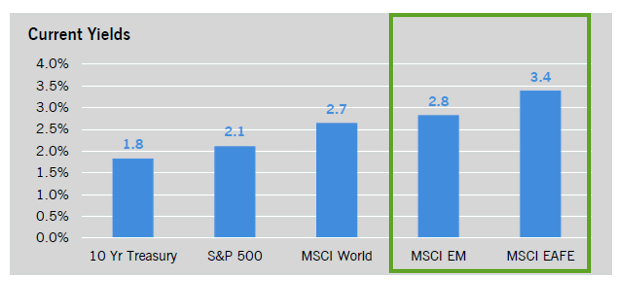

· Yield matters. Yield is a fancy investment term for investment income interest or dividends. In an environment of low interest rates, places where investors can find income are important for future returns. A big part of why foreign stocks and high yield bonds are near the top of Blackrock’s 5-year rankings is the interest and dividend income they pay. Currently, high yield bonds are paying interest rates of close to 7% and emerging market and developed international stocks are paying dividends higher than most government bond rates.

Source: Eaton Vance

· Bonds are a source of diversification, but future return potential is low. The bottom of Blackrock’s list of forecasted 5-year returns is populated with different types of bonds. It does not take a rocket scientist (or an economist) to know with interest rates close to historic lows, the potential for future returns from bonds is also low. The outlook for future returns is the main reason we are “underweight” bonds across portfolios we manage. We recognize bonds can provide a key counterbalance to stocks in the event of market turmoil, but over the longer term, we believe investing in cheaper asset classes with higher income rates are likely produce higher returns.