Back to the Future – Japan Edition

March 1, 2024

To Inform:

“Roads? Where we’re going we don’t need ‘roads’.” When Doc Brown uttered these words to Marty McFly at the end of the Robert Zemeckis hit Back to the Future it is possible some viewers might have believed him. Investors might have had similarly optimistic views for the prospects for Japanese stocks, an investment darling of the day founded on the relentless seeming strength of the Japanese export-based economy. Doc Brown’s prediction hasn’t yet panned out and while Japanese stocks would continue to run for the rest of the decade hitting a peak on the last trading day of 1989, they only just revisited that peak on February 22nd, almost 35 years later.

Why are Japanese stocks only now revisiting the highs they hit in 1989? To answer this, a brief history lesson is in order. Japan experienced a massive asset price bubble in the late 1980s that included not only the stock market, but the commercial real estate market as well. At the peak of the real estate bubble in Japan, Japanese real estate was estimated to be worth four times the value of real estate in the United States. The P/E ratio in 1989 on the Nikkei (the Japanese stock market index) was 60 times earnings. For context, the S&P 500’s P/E at the peak of the Tech Bubble was “just” 30 times earnings. Finally, Japanese tocks represented 42% of the global stock market in 1989, despite accounting for around 9% of global GDP. It’s no surprise that from such lofty heights Japanese stocks failed to retain their prominence in the global investment landscape.

You may be asking what has sparked this recovery in Japanese stocks and whether or not it is sustainable. Valuations look a lot different today, and in a better way. The P/E ratio for Japanese stocks sits somewhere in the high teens, a fraction of the level it hit in 1989. Another way of looking at market froth is to consider how many of the world’s top stocks by market cap were Japanese at the bubble peak. In 1989, 15 of the 20 largest companies globally as ranked by market capitalization were Japanese. Today, just one Japanese company ranks in the 100 largest stocks ranked by market capitalization globally!

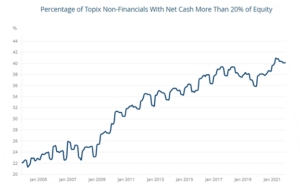

Another factor that contributed to Japan’s “Lost Decade(s)” was poor corporate governance. Management teams in Japan historically were poor allocators of capital, owning significant stakes in non-core businesses and other assets (including overpriced corporate real estate). In recent years Japanese companies have been spinning off or selling non-core parts of their business to better focus their efforts on their core business. Some of this is at the behest of shareholders, some of it at the behest of the Tokyo Stock Exchange, which is threatening companies with delisting if they fail to reach certain metrics for return on equity and valuations. As recently as late 2021, more than 40% of Japanese large cap companies had significant levels of cash on their balance sheets. Today, the pressure is on to distribute this cash to shareholders by either buying back stock or paying out dividends.

Source: Man Group

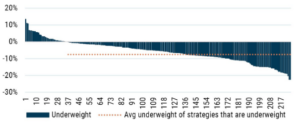

Finally, the “buzz” around Japan is very different today. In the late 1980s investment in Japan was seen as a no-brainer. It was a time where the estimated notional value of the land beneath the Imperial Palace in Tokyo was worth more than the value of all the real estate in California. Today, Japan is hardly considered by investment managers. The graphic below shows the number of international stock managers with overweights or underweights to Japanese stocks as of the middle of last year. A fraction of managers have an overweight to Japanese stocks, with the vast majority having underweights, while some of them own no Japanese stocks at all. What happens to Japanese stocks if these investors start singing a different tune on Japan?

Source: GMO

While a DeLorean with 1.21 gigawatts of power would be the best way to see if Japanese stocks can go “back to the future” and make a run of successive new all-time highs, we’ll have to settle for what we know. Japanese companies are cheaper today, better managed, and still under-owned by the investment community. We have seen that movie before in other geographies and sectors. If Japan Inc. is a repeat of those episodes, grab a bag of popcorn, sit back, and enjoy the show.

Written by Alex Durbin, Chief Investment Officer