Backdoor Roth IRA Update

January 28, 2022

To Inform:

We love Roth IRAs! Tax-free growth for a lifetime – what’s not to love?! If only we could put all our savings in a Roth IRA. Well, unfortunately, there are limits to funding Roth IRAs and one in particular, the income limit, presents some challenges for many of our clients. For some, there is a solution: the backdoor Roth IRA contribution. In this week’s Wealthnotes, we’ll discuss how a backdoor Roth IRA contribution works and discuss why the backdoor Roth IRA strategy has been in the financial news lately.

IRA Contribution Rules

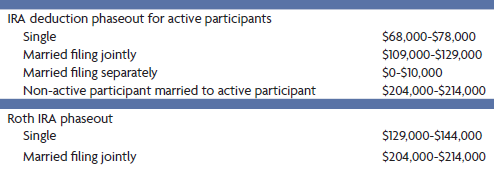

First, here are some important IRA contributions rules. For 2021 and 2022, individuals can contribute up to $6,000 per year per person to a Traditional or Roth IRA ($7,000 if over the age of 50). An individual (or spouse) must have earned income to make the contribution and if earned income is less than $6,000, the contributions are limited to the amount of earned income. In addition, if income is too high, the contribution is phased out or eliminated. Here are the 2022 Modified Adjusted Gross Income limits for Traditional and Roth IRA contributions:

Note: “active participants” refers to participation in a qualified retirement plan.

What is a backdoor Roth IRA contribution?

The traditional IRA phaseout only impacts the ability to actually get a tax deduction for the IRA contribution. As long as there is earned income, anyone can make a Traditional IRA contribution, it’s just a matter of whether or not a tax deduction can be claimed for it. With a backdoor Roth IRA contribution, an individual makes a non-deductible IRA contribution and then converts it tax-free to a Roth IRA. Normally, a Roth conversion would result in taxable income, however, the non-deductible nature of the contribution essentially creates tax basis in the IRA and so if the contribution and the conversion are the same amount the Roth conversion is not taxable.

Simple enough, right? Not so fast. When an individual converts a Traditional IRA to a Roth IRA, the IRS aggregates all IRAs (Traditional IRA, SEP IRA, and Simple IRA) an individual owns and the equation gets more complicated. Let’s look at an example:

Let’s say you have $54,000 in a Traditional IRA and have never made non-deductible IRA contributions before. Now you make a $6,000 non-deductible contribution to a Traditional IRA (note: it doesn’t matter if it is to the same or separate IRA). Your total IRAs are now $60,000, of which $6,000 represents non-deductible contributions (i.e. your tax basis in your IRAs). If you try to convert the $6,000 to a Roth IRA, only 10% of the conversion will be non-taxable ($6,000/$60,000) and 90% of it will be taxable ($54,000/$60,000) as ordinary income.

So clearly this strategy works best for individuals that don’t already have much, if any, balance in Traditional, SEP, or Simple IRAs.

Why has there been so much talk about the backdoor Roth IRA strategy lately?

The Build Back Better Bill proposed last year would have eliminated the ability to convert non-deductible dollars from a Traditional IRA to a Roth IRA which would have effectively killed the backdoor Roth IRA contribution strategy. That bill has stalled, but it doesn’t mean the strategy won’t be on the chopping block at some point through another bill.

In the past few weeks, I’ve e-mailed with several reputable accounting firms here in Columbus to see how they are advising their clients in light of potential future legislation. All have been comfortable with making 2022 backdoor Roth IRA contributions. Although it is possible a bill could eliminate the strategy retroactively to January 1, 2022, the more likely scenario (especially the later we get into the year) would be for the strategy to be eliminated as of the date of the bill or January 1, 2023.

As you consider your tax planning, remember, it’s also not too late to make 2021 backdoor Roth IRA contributions. You have until April 15, 2022 to make IRA contributions for 2021. And one final note: if you do a backdoor Roth IRA contribution, be sure to tell your tax preparer! The implementation of the strategy is not obvious from the tax forms you will receive during tax season and it would be a shame to miss out on this opportunity.

We realize this is a complicated planning strategy with many nuances, so please give us a call if we can help you assess whether the backdoor Roth IRA opportunity is right for you.

Have a great weekend!

Written by Todd Walter, CFP, CPA; Partner and Chief Wealth Planning Officer