Better/Worse is More Important to Markets Than Good/Bad

July 7, 2023

To Inform:

I (Travis) have terrible eyesight. I started with bifocals in 2nd grade and if it weren’t for the contact lenses I have worn since I was a junior in high school, I wouldn’t be able to see anything in front of me. Last week I made my annual trip to the eye doctor and the doctor asked me, “has anything changed with your vision?” I proceeded to explain how I used to be able to see things clearly on television, but as my wife and I watch Ted Lasso, I cannot see the text exchanges between characters which are shown on the TV. The doctor then took me through the series of exercises with different lenses asking if I could see “Better with 1 or 2?, or Better with 2 or 3?…” We then determined my “far away” vision has drifted, but if we correct too much, it could interfere with my “close up” vision. Yesterday I picked up a trial pair of new contacts to see if they could strike the right balance between near/farsighted-ness and ultimately make things better.

So, what does all of this have to do with markets? Maybe it’s what I do for a living, but the idea of “trying to see far away while also trying to see close up and putting it all together to make things better” has investment analogy written all over it. Specifically, it reminds me of a concept we talk a lot about in our Investment Strategy Team meetings:

Markets tend to respond more to better/worse than good/bad.

The backdrop for markets the first half of 2023 was strange. Starting with professional forecasters looking for an impending recession with a historically high probability, then adding in multiple rate hikes and large bank failures, few would have said the first six months of the year would result in a 16%+ increase in the S&P 500. But that’s what happened. Why? The outlook for a recession is still “bad” but it’s gotten “better.”

The chart below shows the probability (forecast) of a global recession over the next 12 months. The blue line is the median, and the bars are focused around the 50% level. Prior to 2023, the probability of future recession has generally been less than 50% (bars pointing down) with the exception of COVID. Since mid-2022, the probability of future recession has been as high as 65% but in recent months that probability has been declining. Even though today’s probability is still over 50% (bad), the lower number is BETTER than a few months ago.

Source: Bloomberg, Absolute Strategy Research Ltd.

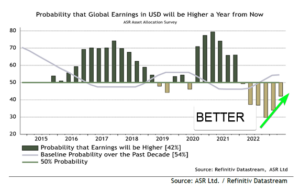

Let’s look at another chart – the probability global earnings will be higher a year from now. Recently, the probability of higher earnings over the next 12 months has been at the lowest levels in close to a decade (bad) but that probability has been growing and is getting closer to a coin toss (50/50 odds). Still bad, but BETTER. Investors had been braced for earnings to fall and many are surprised earnings are not falling by more…and BETTER is enough to raise confidence and asset prices.

Source: Bloomberg, Absolute Strategy Research Ltd.

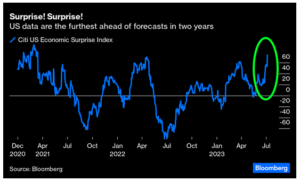

One more chart brings this better/worse concept home. The Citi Economic Surprise index rises when economic data is coming in better than forecasts expect and falls when economic data is coming in worse than forecasts expect. As you can see from the green circle, economic data since March may not be wonderful, but the rising line means data has more than cleared the hurdle of low expectations.

Source: Bloomberg, Citigroup

So, what do we do with this as investors as we look forward to the rest of 2023? Remember the concept:

Markets tend to respond more to better/worse than good/bad.

As investors start to take today’s “better” news and project it forward, they may start to feel like things are “good.” And, feeling like things are good, by definition, “feels good” in the near term. But, if we apply some far-sightedness, more volatility could lie ahead as “feeling good” means there is less room for things to “feel better.”

When it comes to taking action in portfolios, my new contact lenses may be an apt analogy. We need to strike the balance between seeing things close up while still looking to see things far away and ultimately make the best decision to make things better for our clients.

Have a great weekend!

Written by Travis Upton, Partner, CEO and Chief Investment Officer