Beware Dividend Hogs

July 16, 2020

To Inform:

Growing up, one of the most joyous weeks of the year was the week of the county fair. I raised hogs as 4-H projects and the fair was a culmination of a few months of hard (and pungent) work. I’ll always have a fondness for hogs and not just because they are the world’s only known source of bacon. One hog I’m less fond of is what’s known in the investment world as the “dividend hog”.

A dividend hog is a company whose cash flow is consumed by the dividend they pay. Companies have three opportunities to deploy the cash they generate. Pay it out as dividends, buy back stock, or invest it for future growth. Some companies do all three, some just one or two. A way to gauge just how much a company is paying out in dividends is to look at the company’s payout ratio. This can be measured by taking the dividend paid and dividing it by either net income or cash flow. Dividend hogs have payout ratios often exceeding net income.

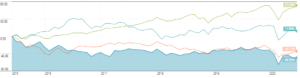

It goes without saying that a company paying out all (and sometimes more) of its net income as dividends could struggle to grow. For some companies in mature industries, this may be the wisest course of action. It is far better to return cash to shareholders than invest in projects that aren’t likely to add value. Where investors can run into trouble is pursuing dividends without respect to a company’s long-term prospects. The chart below includes returns over the last five years for a handful of companies that all have exhibited very high payout ratios. These companies represent different industries and range in size from small to large.

Source: Morningstar

The top line represents the S&P 500, which returned 71% over this period of time. The high payout stocks had returns in a range of +11% to -48%. Keep in mind, these returns include the dividends paid by these companies during this time period. It is likely these companies sported eye-popping yields that may have hooked income-focused investors. One favorite example is a telecommunications company that shall remain nameless. For much of the last decade, this company’s dividend yield was in the 6-10% range. In light of anemic bank deposit rates, that might sound tempting. Unfortunately, this company was in a declining industry and eventually ended up filing for bankruptcy. Investors collected some dividends along the way, but in the end their capital was wiped out.

Dividend investing can be a powerful tool in generating long-term wealth. Companies that pay a dividend and increase it over time can turn out to be fantastic long-term investments. As with all things, though, the rule of caveat emptor applies – if a yield looks too good to be true, it probably is. Don’t let a dividend hog stink up your portfolio!

This WealthNotes Inspire was written by Alex Durbin, TJG Portfolio Manager

This WealthNotes Inspire was written by Alex Durbin, TJG Portfolio Manager