Beware Of Fed Chairman Jumping Out Of Cakes

June 14, 2018

To Inform:

On June 13 the Federal Reserve increased short-term interest rates by 0.25%, taking the upper end of the range of the Fed Funds rate from 1.75% to 2.00%. Was the market surprised by the increase? Not at all! Due to strong economic and employment data, the market was not only expecting this rate increase but is expecting two more increases for the balance of this year.

We will often get the question, “How does the Fed increasing rates impact the markets?” Let’s dig into some details and then come back to the question. The Fed controls the Fed funds rate which is a foundation for short-term interest rates. When the Fed increases rates, money market funds and floating rate loans should adjust relatively quickly. But when it comes to the impact on longer-term bonds and the stock market, it’s not the increase in rates that matters – it’s the change in expectations about the future. Said differently, it’s not the party that matters, it’s whether anyone (in this case, Fed Chair Jerome Powell) jumps out and says “surprise!”

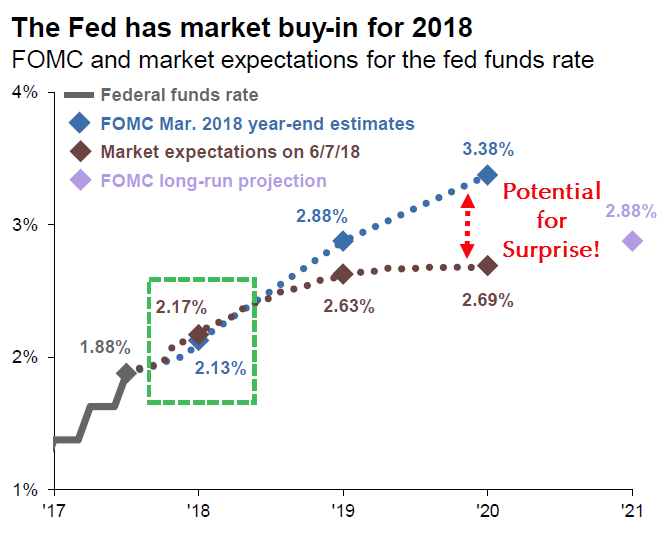

The chart below helps tell the story.

Source: JP Morgan Asset Management

Source: JP Morgan Asset Management

Pay attention to the difference between the blue line and the brown line. The blue line reflects the Fed’s recent estimates of the path of the Fed Funds rate while the brown line reflects the market’s recent estimates of the path of the Fed Funds rate. For the rest of this year and into 2019, the market and the Fed seem pretty well in sync – going into 2019, the Fed is likely to raise rates 3-4 more times (with two more 0.25% hikes are priced in for 2018).

It’s going out in late 2019 and beyond that gets interesting. The Fed (brown line) is indicating they will keep hiking rates while the market (blue line) is saying the Fed will pause. In other words, the market is essentially saying “you may say you will hike rates further, but we don’t believe you.”

So, to come back to the question, “how does the Fed increasing rates impact the markets?”, it’s not the current rate hike that matters – it’s whether there is a surprise that moves future expectations. The recent Fed hike was expected and right now, the Fed and the markets are in sync. That’s why even though the Fed hiked rates on June 13, the 10-year Treasury bond had a rate of 2.96% on June 12 and still has a rate of 2.96% on June 14.

Looking to 2019 and beyond, the Fed seems to believe inflation may heat up, unemployment will continue to decline and growth will continue at a strong pace. The market, however, seems to believe the Fed is too optimistic and growth is likely to level off. It’s whether the Fed comes around to the market’s way of thinking, or vice versa, for 2019 and beyond, that has the biggest impact on markets.