Charts I Find Interesting

June 6, 2025

To Inform:

Every month our Chief Investment Officer, Alex Durbin, puts together a packet of charts with perspectives on markets and asset classes we call our Market Health Analysis (MHA). While Alex puts the ultimate document together, I try to help him out at the beginning of the month by putting charts I find interesting together to give him material to use.

I don’t know if Alex will use any of the three charts below for our June Market Health Analysis packet, but I thought they were interesting!

Uncertainty

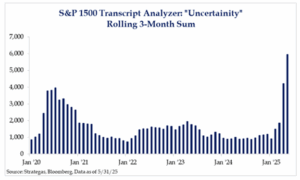

First, at the risk of stating the obvious, uncertainty reigns in the current market environment. The chart below shows the output of an “earnings report transcript analyzer” for large, medium, and small sized public companies. The results show that over the last three months, corporate earnings reports have used the word “uncertainty” when discussing the future earnings outlook more than any other time in the last five years, and that includes the COVID period.

Source: Strategas Research Partners

Like the companies issuing their earnings reports, our Investment Strategy Team has also used the word “uncertainty,” but we couple it with the word “anti-fragile.” The uncertain environment means we need to focus on how we can position portfolios to succeed in achieving their objectives regardless of what may lie ahead. Making a portfolio “anti-fragile” means considering other asset classes – high quality bonds, high yield bonds, infrastructure, foreign stocks, among others and not just the U.S. stocks which are in the headlines.

TACOs

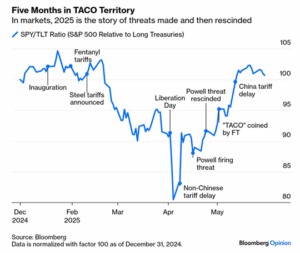

Despite the reigning market uncertainty, as I type, the S&P 500 is less than 150 points, or about 2.5% from its all-time high achieved in February of this year. The market has come roaring back from the tariff declines in April and despite daily headlines regarding new tariffs, tariff delays, and potential trade deals being on or off, it seems the “psychology” of the market has adjusted to tariff headlines. But why?

The financial media loves acronyms and the current acronym being thrown around by Republicans and Democrats alike was coined in May by the Financial Times – TACO, or “Trump Always Chickens Out.”

Source: Bloomberg

The TACO acronym is not a political statement, but rather an observation that over the last five months, a “harsh” announcement regarding tariffs or trade has generally been followed by a delay or backing off. As a result, tariffs and new announcements seem to be seen as more of a negotiating tactic than something with long-term economic impact. Our CIO Alex Durbin has talked about “spinach and candy,” but the market seems to be finding TACOs much easier to digest.

Soft Data Catches Up to Hard Data

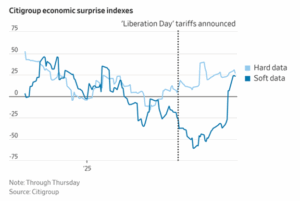

In recent weeks, the financial media has talked a lot about the difference between “hard data” and “soft data.”

- Hard data refers to backward looking, factual statistics such as payroll numbers or the prior month’s inflation data.

- Soft data refers to surveys which attempt to look forward and capture the way different economic groups are feeling. Examples include ISM manufacturing surveys and consumer confidence surveys.

Since the big tariff announcements, “hard data” has remained strong, indicating a strong economy, while the “soft data” surveys have been weak, indicating different groups do not feel as good about the future. Pessimistic economists have pointed to the weak soft data as proof we may head into a recession later this year as the hard data eventually rolls over.

Source: Citigroup, Wall Street Journal

Well, a report this week in the Wall Street Journal showed that’s not what is happening. Hard data regarding the economy has remained strong (and has even increased) and the soft data has come roaring back. Consumers, company CEOs, and other groups are feeling much better about the economy than they did in April. Why is this important? We’ve seen different investment banks lower their odds of an impending recession as strong factual data coupled with stronger forward-looking surveys (not to mention a recovering stock market) makes it harder to make a case for recession.

Despite the uncertainty out there, we’ve seen improving economic sentiment and a rising stock market. As I type this, the closely watched monthly jobs (non-farm payrolls) number announced this morning came in better than expected and stocks are rallying. Perhaps we should all enjoy eating TACOs this weekend to celebrate!

Written by Travis Upton, Partner and Chief Executive Officer