Checking in on Real Assets – What is the Market Telling Us?

May 17, 2024

To Inform:

The Joseph Group’s Head Trader and Investment Operations Associate Andrew Burkey often says, “What is the market telling me?” What this statement implies is there is information embedded in the price movement of the market and investors can sometimes benefit from looking at prices to determine a fundamental story. What is the market telling us specifically with regard to real assets – real estate stocks, infrastructure, and commodities – and what might be the underlying fundamental story?

Year to date, the index tracking global real estate stocks is slightly negative but has rebounded nearly 8% in the last month. The story this year has been interest rates staying higher for longer, but it is possible the recent rally in real estate stocks is telling us the long-awaited cuts to the Federal Reserve’s Fed Funds Rate will indeed materialize this year. Just in the last week the market has gone from pricing in 60% odds of two cuts this year to nearly 80% odds. Even modest relief in interest rates can ease the burden on real estate stocks and benefit a diversified portfolio.

Source: Daily Chartbook

Infrastructure stocks (pipelines, utilities, cell towers, etc.) have been a different story. While often considered a “bond proxy” this area of the market has seemed to shake off the pessimistic shifting of expectations for interest rate cuts this year with an index that tracks global infrastructure stocks up over 7% this year. The rally in this area of the market since the February lows is a sight to behold, up 13% in a few months.

Source: YCharts

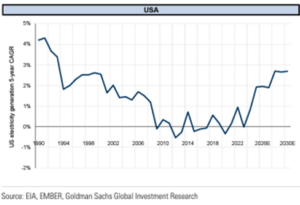

What might the market be telling us here? Part of this story is the rise of utility stocks, up a whopping 20% since mid-February. How do we square the circle of rising utility stock prices and higher interest rates? Perhaps it’s the growing consensus that electric power consumption is beginning to grow, after decades of declining growth as shown in the chart below. Where is this growth coming from? Look no further than our own backyard as data centers in places like Ohio rise from what were once farm fields. Just this week the Columbus Dispatch published an article discussing a local utility’s proposal to handle the increasing demand for power from data centers while protecting residential customers.

Source: Goldman Sachs

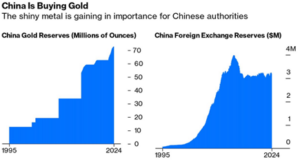

Finally, after being one of the few major asset classes to decline in 2023, commodities are once again rallying. Commodities across the spectrum – precious metals (think gold), industrial metals (think copper), agricultural commodities (think cocoa, wheat) – have all rallied in 2024. The supply and demand characteristics for many of these commodities remain supportive of higher prices as producers struggle to increase output and/or buyers overwhelm the market with demand. Consider the case of China and its relationship to gold. China has steadily increased their gold reserves over the last few decades. Despite this rise, China would need more than 10 times more gold reserves to equal the U.S. in terms of gold reserves per capita.

Source: Bloomberg

Markets are indeed telling us something about real assets, an often-overlooked corner of the market. Time will tell the duration and significance of these stories, but if there is any traction to these stories, it is possible the market is just getting started.

Written by Alex Durbin, CFA – Chief Investment Officer