Checking In on the Economy

July 26, 2024

To Inform:

We’re often asked where we think markets stand in relation to the business cycle. While we believe in the statement, “the stock market isn’t the economy,” we think it still makes sense to have a picture as to what is going on in the economy and how developments today may be affecting markets tomorrow. Some of the most important economic variables we track include those related to the labor market, consumer spending, and business production.

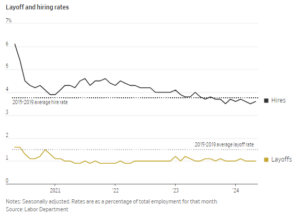

Let’s start with the labor market. If you’ve followed Travis or I over the past several years, one of the things you may have picked up on is just how strange the labor market became after COVID. In these pages we’ve talked about the gap between jobs available and the total supply of workers looking for jobs. After spending much of the post-COVID years in extreme territory, this gap has settled into pre-COVID norms. This week the Wall Street Journal published an article discussing this shift in the once hot labor market and quoted one economist saying, “I’m not sure that labor market was ever sustainable. It was built on the back of a huge COVID shock.” The chart below shows just how unsustainable the labor market was. The hiring rate in some months (new jobs divided by total jobs) was as high as 5-6%, compared to a pre-COVID average of under 4%. While layoffs remain below average, it is worth noting that employment growth is likely to slow.

Source: WSJ

A healthy labor market is a key factor in sustaining consumer spending, which drives more than two-thirds of economic growth. On this point, we think the data is mixed. Consumer spending is growing (as seen in the chart on the left) but consumer confidence (the chart on the right) remains a challenge. This is likely a reflection of consumer displeasure with inflation. While inflation has been declining in recent months and is well off levels seen in 2022, consumers hardly find solace in the fact their grocery bill (which is up a lot) isn’t up as much recently.

Source: Strategas

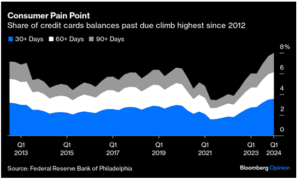

Stress on the consumer is often gauged by looking at delinquencies on payments for credit cards, auto loans, and other household debts. Credit card delinquencies have increased to above pre-COVID levels as we can see in the chart below. That said, this problem is unlikely to be a problem as long as layoffs remain contained and unemployment steady.

Source: Bloomberg

Finally, production surveys and data provide us with a sense of what is happening with the “real economy” – hard goods and construction. Again, the data is mixed. U.S. manufacturing data remains in contraction and has been for nearly 2 years. On the other hand, the industrial production index which includes things beyond manufacturing (think mining, oil & gas, electricity production and the like) continues to grow after spending the second half of 2023 in decline.

Source: Strategas

The evidence here – whether you look at the labor market, consumer strength, or business production – is that the economy is in decent shape but the days of sharp growth in this business cycle (usually seen coming out of a recession) are likely behind us. This not too hot, not too cold sort of environment is one in which markets can do pretty well but where in markets matters. That’ll be a story for another WealthNotes!

Written by Alex Durbin, Chief Investment Officer