Checking in on the Recovery

August 6, 2021

To Inform:

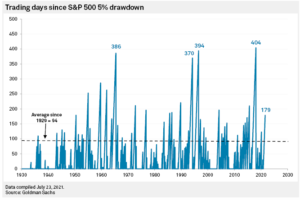

As we wrap up the dog days of summer and enter a period that has been historically weak in the stock market, it’s worth checking in on some of the key indicators that point to the strength of the economic recovery. We’re now approaching 200 trading days without so much as a 5% down move in the S&P 500. As you can see on the chart below, these lengthy periods of placid markets don’t last forever. It shouldn’t come as a surprise if this streak is broken in the coming weeks or months. The question will be, of course, “can it continue?”. Having a sense for what a mix of economic indicators are saying may be helpful in determining whether a 5% drawdown is just another garden variety correction or the start of something more meaningful.

Source: S&P Global

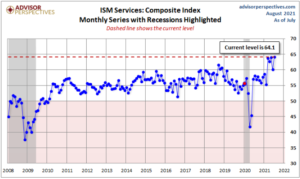

Starting with the services sector (think nearly everything not manufacturing related) of the economy, the most recent reading released on August 4th showed the Services PMI at 64.1, a record high. A number below 50 represents a contraction in this segment of the economy. As you can see, we’ve been “running hot” for several months, despite lingering uncertainty around COVID-19. Respondents are commenting on challenges finding labor and pent-up demand for services. This number can be volatile, but absent a pandemic it isn’t very probable it goes from record high territory to contraction in short order.

Source: Advisor Perspectives

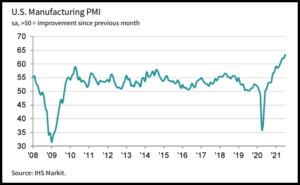

How about manufacturing? We know this is an area where supplies are constrained and labor is in demand. The number here is also at an all-time high. While it would be encouraging to see supplies catch up with demand and more workers returning to the labor force, this is a good sign.

Source: 361 Capital

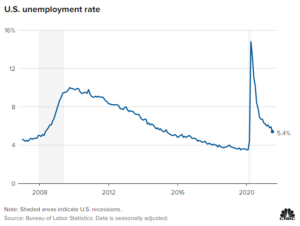

The employment picture has been strong all year on an absolute basis, but recent summer month non-farm payrolls numbers have disappointed, coming in below expectations. This wasn’t the case with the number released this morning, showing a 943,000 increase in payrolls in July, ahead of expectations by nearly 100,000 jobs. This was the best jobs number since August of 2020. This number pushed unemployment down to 5.4%, the lowest since the start of the pandemic. For the economic recovery to have legs, more folks working and collecting a paycheck is crucial, especially in light of ending stimulus payments.

Source: CNBC

The story of the economic recovery remains intact, but as we’ve reiterated a number of times since last year, the market is not the economy. Corrections can and will come along, even with great economic numbers in places like services, manufacturing, and employment. If we get one of these corrections it’ll invariably be linked to some particular headline. More often than not, these headlines are forgotten and the economy (and the market) continues to plod along.

Written by Alex Durbin, Portfolio Manager