China’s Reopening – Discussing the Impacts

December 9, 2022

To Inform:

A major disappointment for markets this year has been the absence of one of the key engines of global growth: China. Regardless of whether one is invested in Chinese stocks, the impact China has on global markets is profound. We’ve seen this play out in a variety of ways over the last three years with the initial outbreak of COVID-19, supply chain snarls, and the Chinese property market in shambles. More recently, it appears the patience Chinese citizens have toward their government’s “Zero Covid” approach is wearing thin, opening a new chapter in the saga of Chinese economic developments.

The frustration with the government’s approach has been on full display recently, with significant protests occurring across a number of Chinese cities. Earlier this year, lengthy and strict lockdowns saw people forced to stay in their homes for weeks on end, testing for COVID-19 infections daily. These sorts of stringent controls, three years after the initial outbreak, are beginning to fragment.

In recent days, the BBC reports that China has begun to loosen their guidelines – allowing people to quarantine at home, to attend large events without testing, and to travel more freely within the country – in an effort to placate a weary population. The same BBC article captured a quote from a Chinese citizen on social media asking the same question many of us are asking, “Can anyone explain to me what’s happening? Why is the change all of a sudden and so major?” We think Chinese leadership is realizing the economic damage from “Zero COVID” policies is becoming too difficult to bear.

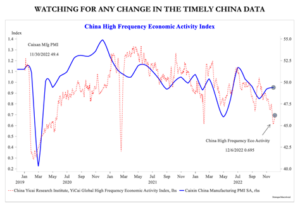

China rebounded nicely in the months immediately following the original COVID-19 shock, with manufacturing in clear expansion (the blue line in the chart below) and economic activity (the red line) returning to pre-COVID 19 levels. This recovery has waned over the last 24 months, with manufacturing weakening and economic activity at moribund levels more akin to the very early days of the pandemic. In recent weeks there’s been a tone change from the government and from markets.

Source: Strategas

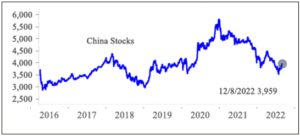

After a lengthy period of lackluster returns for Chinese stocks that coincided with the economic weakness seen above, Chinese stocks appear to now be breaking out. An Index that tracks the returns of a range of Chinese large cap stocks is up 39% since bottoming on Halloween. Currency moves are also indicating that China may be through the worst, as the Chinese Yuan has begun to reverse its long slide relative to the US Dollar, with the Chinese Yuan appreciating almost 5% relative to the dollar over the last 6 weeks.

Source: Strategas

The economic impacts of a reopening China go far beyond Chinese stocks and the Chinese Yuan. For investors in diversified portfolios – ones that own a mix of global stocks, bonds, and real assets – China’s reopening has major implications. Bonds have struggled this year with sticky inflation and a Federal Reserve in hiking mode. A healthier (economically and physically) China helps to mitigate some of the supply chain driven issues around inflation, perhaps allowing central banks to slow or stop hiking interest rates, reducing the risk of further price declines in bonds (remember bond prices fall when interest rates go up). Investors in stocks would benefit from a more measured pace of inflation, as the same forces (inflation and rising interest rates) that have been hurting bonds this year tend to weigh on stocks as well.

Finally, investors in real asset funds or strategies with an exposure to commodities will likely benefit from increased demand for things like oil and gas, industrial metals (copper, nickel, aluminum, and others), and agricultural commodities. In the portfolios we have the privilege of managing for clients, we’ve been considering these impacts. More recently we’ve gotten more comfortable with high quality bonds, while at the same time maintaining exposure to stocks and real assets for their potential to benefit from China’s reopening.

We’ve been encouraged by the early signs of positive impacts on markets from a more balanced approach to COVID-19 in China. The size and significance of China and their impact on portfolios both here and abroad makes recent developments worth paying close attention to. This reopening process and the path it takes is one of the key factors for markets in 2023 and is one of the things we’ll be focusing on in the weeks and months ahead.

Written by Alex Durbin, Portfolio Manager