Client Mailbag Ahead of Portfolios at Your Place

January 8, 2026

To Inform:

Next Wednesday afternoon, TJG Partner and Chief Investment Officer Alex Durbin and I will be hosting our beginning of the year “investment themes” event which we are calling TJG’s Picks for 2026. We have been receiving some questions ahead of the event, so we thought we would tackle a couple of those questions in this edition of WealthNotes.

Question: Where will the 10-year Treasury end in 2026?

As much as I would like to give a definitive answer to this one, predictions which use both a time and a number tend to get investment people in trouble. That said, the rate on the 10-year Treasury is currently 4.18% and the 12-month forecast from a noted large investment bank is 4.20%. In other words, they aren’t expecting the 10-year Treasury rate to move much over the next year.

One of the themes we will discuss next week is “Rates: Higher for Longer for Longer.” Alex gets credit for the catchy title, and he is saying even though the Fed may cut short term interest rates in 2026, we may continue to see higher long-term interest rates for a longer timeframe than people expect. Why? Stronger growth, tariffs, inflation, national debt, and additional government stimulus could all put upward pressure on long-term interest rates.

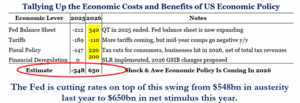

When we work out our themes for the year, it’s always with a view of what may cause us to make proactive and reactive moves in portfolios. As we look forward to 2026 there is a LOT of economic stimulus coming in the form of an expanding Fed balance sheet, tax cuts, and favorable comparisons on tariffs (see table below).

Source: Strategas Research Partners

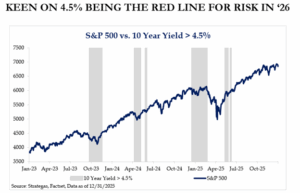

In general, economic stimulus is thought to be good for the economy, BUT that stimulus could put upward pressure on interest rates. Strategas Research Partners has noted over the last few years that anytime the 10-year Treasury has exceeded 4.5%, it has led to a more volatile environment for stocks.

Source: Strategas Research Partners

Bottom line – the big investment banks are pointing to an “unchanged” year for long-term interest rates, but we’re looking out for higher-than-expected rates and if it happens, how it could create surprises for other areas of the market.

Question: Will International stocks outperform U.S. stocks the next two years?

It actually happened in 2025 – foreign stocks outperformed U.S. stocks. The MSCI EAFE Index of developed market foreign stocks was up about 31.5% in 2025 compared with 17% for the S&P 500. If we look at foreign stocks without the currency impact, they STILL outperformed U.S. stocks – up about 23% with a weakening dollar adding another 8% to foreign stock returns.

When we look at “Can Foreign Stocks Repeat as Champions?” we believe there are three key factors:

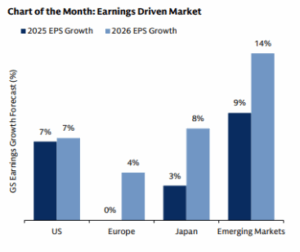

Earnings Growth. The chart below shows earnings are expected to accelerate for different areas of the world. While U.S. earnings growth is good, the rate of change for foreign earnings growth is even better.

Source: Goldman Sachs Asset Management

According to data from JPMorgan, foreign stocks, despite their outperformance last year, trade at a -32% discount to U.S. stocks. Some may argue, “foreign stocks should trade at a discount to the U.S.” and they may be right. However, the 20-year average discount of foreign to U.S. stocks is about -19%, suggesting the current level of -32% gives room for foreign stocks to appreciate.

Weaker U.S. Dollar. When the dollar weakens relative to other currencies, it’s a positive for U.S. investors in foreign stocks (and vice-versa – a rising dollar is a negative factor). Last year, a weaker U.S. dollar added about 8% to the return of the MSCI EAFE Index. The direction of the dollar is perhaps the hardest factor to forecast, but deficits and Fed rate cuts could put further downward pressure on the dollar in 2026 and would therefore support foreign stock performance.

Putting it all together – accelerating earnings growth, discounted valuations, and potential further weakening of the dollar, we could have the trifecta needed for foreign stocks to repeat as champions.

Next week at Portfolios at Your Place, Alex and I will be reviewing all nine key themes which we are calling “TJG’s Picks for 2026.” We invite you to join us on Zoom (register here!) and please feel free to invite a friend!

Written by Travis Upton, Partner and CEO