Conquer College Costs

September 20, 2024

To Inform:

A couple of months ago I had the pleasure of presenting a webinar, “Planning for College Costs: What You Need to Know,” alongside Joseph Group advisor Jake Martin. I loved the topic and thought it would be a great one to revisit here.

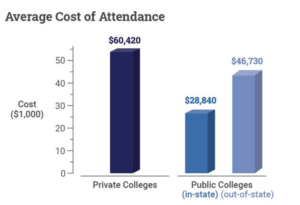

Before we get into the planning strategies, let’s start with the average cost per year to attend college.

Source: College Board, Trends in College Pricing and Student Aid, 2023

At The Joseph Group we want to start all planning conversations around purpose. Below are a few purpose-driven questions that frame the technical advice around planning for college expenses.

- Do you want to pay for 100% of your child’s college expenses?

- Do you feel it is important for your child to have some $kin in the game?

- How do you feel about your child having some student loan debt?

Next, let’s think about what college really costs. For example, the public in-state cost above is $29,000 per year; however, there are a few things that annual price tag does not take into consideration. We encourage all families and students to take advantage of any available financial aid, grants, and scholarships. The average student attending a public university receives $7,000 per year in scholarships and grants.* These can be found in several places, such as colleges, employers, religious organizations, federal, state, and local government websites, and more. We encourage students to apply for as many scholarships as their heart desires.

Even with the average student receiving $7,000 per year in scholarships that leaves another $22,000 per year in regular college expenses, and this is where the financial planning can come in. While there are a number of strategies when it comes to college funding the one you may hear the most is a 529 account. Even when children are young, we often encourage our clients to open a 529 account to begin saving a little each year to help pay for college expenses down the road. The major benefit of the 529 account is the tax-free growth of college savings, so long as the money is used for college expenses. There are many other strategies and investment avenues to pay for your child’s education. Other things to consider include Coverdell education savings accounts, custodial accounts (UTMA/UGMA), or using regular cash flow from a brokerage or savings account.

The accounts above outline many avenues for educations savings, but knowing the best avenue for you and your family likely requires more than a short WealthNotes. Our advisors at The Joseph Group are more than happy to have an in-depth conversation around your financial plan and what education savings tools make the most sense for you and your family.

Written by Ryan Kuhn, Wealth Advisory Associate

*Source: Heidi Rivera, Bankrate: Scholarship and Grant statistics