Courage, Cheer, Resolution – In Life and In Investing

April 9, 2020

To Inform:

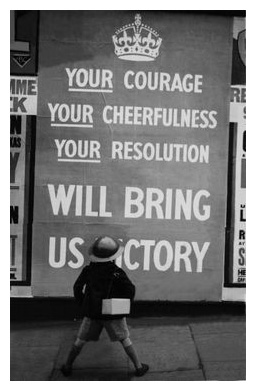

If you’re like me, looking to the past can be a great way to find lessons on how to navigate the present. On Winston Churchill’s first day as Prime Minister of the United Kingdom, Adolf Hitler invaded Holland and Belgium. The evacuation of British troops surrounded at Dunkirk was only  two weeks away. Over the course of the next twelve months, Hitler’s Luftwaffe would relentlessly bomb the island of Great Britain, taking the lives of 45,000 Britons. A sign popular at the time encouraged Britons to be courageous, cheerful, and resolute.

two weeks away. Over the course of the next twelve months, Hitler’s Luftwaffe would relentlessly bomb the island of Great Britain, taking the lives of 45,000 Britons. A sign popular at the time encouraged Britons to be courageous, cheerful, and resolute.

While the early days of World War II aren’t a perfect comparison to today’s ongoing pandemic, there are parallels. As in the early years of 1940 we face tremendous uncertainty and questions that remain unanswered. While we may be unable to answer some of those questions, we can remember those valuable traits exhibited by those who navigated similarly uncertain events in the past.

We’ve all seen courage lately. We’ve seen it in the health care workers working long shifts on the front lines and in America’s grocery workers and truck drivers who shoulder a tremendous burden to ensure we all have access to food. Resolution acts in concert with courage. It’s one thing to have courage for a day, it’s entirely another thing to be resolute in our courage day after day, week after week, and month after month. Cheerfulness is ours if we can find joy in the small victories. Cheerfulness is what allows us to come back each day with a renewed sense of courage and resolution.

These lessons can undoubtedly be applied to investing. Ensconced in our homes and offices, we’re wary to consider ourselves courageous in the traditional sense, but confronting a shifting investment landscape with the courage to act or, maybe more importantly, not act, is crucial. It is tempting to lose courage when the horizon darkens. We’ve made a number of adjustments to your portfolios in the last few months that have been from a position of courage, not fear.

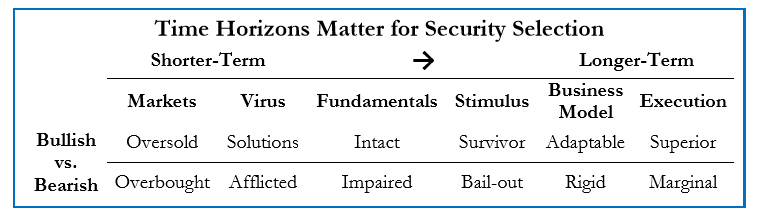

Source: Stragegas

One way of thinking that has helped us is by using the framework above, published by Strategas, one of our research partners. We can control very little in the shorter-term, but where we have more control, the medium and longer-term, we’ve been acting when necessary. In a few cases, either with individual stocks in Home Grown or in the strategies we use in a model like Provision, we felt we could act in a positive way by making changes to the portfolio.

Resolution, that ability to endure the daily ups and downs is, without doubt, a requirement to successfully navigating today’s environment. How is that done in such uncertain times? Knowing that “this too shall pass” and finding joy in the small victories of the day is, in a word, cheerfulness.

We’ve had a tremendous relief rally off the lows in the S&P 500. At the time of this writing, the S&P 500 is up over 27% from the intraday low of the year on March 23. We don’t know which way the markets will go next, but we do know courage, resolution, and cheerfulness are some of the best traits to have in navigating these times with strength. We vow to continue doing so. We’ve received a number of notes from you and it is beyond doubt that many of you are navigating your own lives in the same manner. We cannot express how encouraging that is to see. We look forward to being on the other side of this and until then here’s to courage, cheerfulness, and resolution!

This WealthNotes Inform was written by Alex Durbin, CFA, The Joseph Group Portfolio Manager.