Debt Downgrade – Crossing the Rubicon or No Big Deal?

August 4, 2023

To Inform:

Julius Caesar crossed the Rubicon River in 49 BC, ultimately cementing his role as Dictator Perpetuo of the Roman Republic. Some sources say that before crossing Caesar said alea iacta est (“the die is cast”). Many are wondering with the ratings agency Fitch’s downgrade of US government debt this week if the US itself is crossing a rubicon of sorts. Fitch joins S&P, who downgraded US government debt in 2011, becoming the second of three major ratings agencies to no longer ascribe AAA ratings to US government debt. This move warrants questions around the impact of a debt downgrade to AA+ and whether it leads to precipitous increase in borrowing costs and fiscal stress or do markets generally shrug it off as they did in 2011 when S&P issued their downgrade.

For clues on the immediate impact of the downgrade we look to government bond yields and the US dollar. When Fitch issued the downgrade on Tuesday, August 1, the US 10Y Treasury moved higher immediately, and continued trading higher through Friday morning, approaching 4.2% from a level just under 4% to start the week. It’s too early to tell, though if this is an overreaction to the news or indeed a downgrade puts a higher floor on rates as investors demand higher yields for “riskier” debt.

Source: CNBC

Some may wonder if the downgrade to the US’s credit rating is evidence of a further weakening of the US dollar. Much attention has been paid to the sustainability of the US dollar’s role as the global reserve currency over the last year or so. While that debate rages on, it would appear that the news had no negative impact on the dollar. The value of the US Dollar Index actually rose throughout the day on Tuesday and continued trading higher throughout the week before turning down on Friday’s relatively normal monthly jobs report. The evidence here suggests that, so far, market participants aren’t ready to remove the crown from King Dollar. If the downgrade were seen as a “Rubicon moment” it is more likely the dollar would have weakened on the news.

Source: Marketwatch

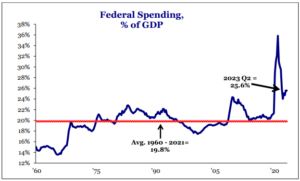

All of this seems to suggest that the downgrade is not being perceived by the market to be a major event. While I agree with that reading, this is a relatively concerning shot across the bow. The US fiscal situation, like many other developed countries, is not good. Interest costs as a percentage of tax revenues is rapidly approaching 14%, a level historically that has presaged tax hikes and restrictive fiscal policy. The massive fiscal response to COVID and the ongoing higher level of government spending that is well above historical norms is not sustainable. Federal spending as a percentage of GDP is over 25%, well above the long-term average closer to 20%, and this is in an economic expansion when spending should actually be much lower as a percentage of GDP.

Source: Strategas

So, is this a crossing of the Rubicon? Only time will tell, but the market’s initial seems to argue that it’s no big deal. Though stocks sold off briefly after S&P’s 2011 downgrade, the dollar strengthened, and bond yields fell. The S&P downgrade was definitely a non-event. How this all plays out in this round remains difficult to handicap as the US fiscal situation is much different today than it was in 2011. We do think having a portfolio with “insurance” against higher bond yields and currency declines is prudent. In many client portfolios we have the privilege of managing modest allocations to real assets and commodities like gold, which should do well if indeed this event is a crossing of the Rubicon. Whatever the final outcome, this latest “event” confirms our view that the pre-COVID world of low macroeconomic volatility is not coming back any time soon, and investors who are prepared for a range of outcomes both good and bad will likely navigate these rivers better than most.

Written by Alex Durbin, CFA , Portfolio Manager