Divergences – When the Market is Telling Two Different Stories

July 23, 2021

To Inform:

Markets often tell a reliable story. Rising interest rates, usually an indicator of a strengthening economy, often portend better times ahead for banks. Small cap stocks are outperforming? It’s likely value stocks are as well. Interest rates are falling? The dollar is likely weakening. These aren’t hard and fast rules, but they’re likely to be true much of the time. When these usually reliable relationships are out of sync, it is wise to pay attention.

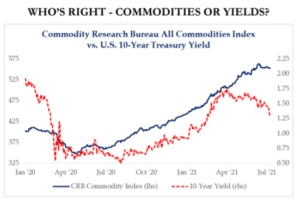

One area we’re seeing divergences today is in commodities. If rising interest rates are an indicator of a strengthening economy, the inverse would imply slowing economic growth. Commodities often will advance with interest rates, as resource prices typically go up in a stronger economic environment. Over the last few months we’ve noticed interest rates backing off, but commodities haven’t similarly cooled. The chart below from Strategas shows recent trends in commodities and interest rates. For much of the last 18 months, they’ve been tightly correlated. Since the end of March, however, they’ve diverged. This likely gets resolved with either interest rates resuming their upward trend or commodities backing down. In client accounts with commodity exposure we’ve slightly decreased our commodity exposure to mitigate the impact of a possible flattening or even decline in commodities from these levels.

Source: Strategas

Another place we’re seeing an interesting divergence is the recent strength in the US Dollar despite a decline in the 10-year US Treasury Bond. All else being equal, a rise in government interest rates in the US will likely lead to an increase in the US Dollar. For the first part of this year, that’s exactly what happened. The chart below shows the US Dollar along with the yield on the US 10-year Treasury Bond. They tracked closely through the end of March, with the dollar then declining as rates fell in April and May. Despite further declines in interest rates in June and July, the US Dollar has gone up, nearly back to its highs on the year when interest rates were much higher! This divergence is likely to resolve, either with a resumption in the trend of higher interest rates here in the US or a decline in the dollar.

Source: Koyfin

For the sake of brevity, we’ll end our discussion here, though there are several other divergences occurring in various asset classes. Divergences aren’t warning signs, per se, but they are flashing lights telling investors to proceed with caution. The resolution of a divergence can have a meaningful impact if one is positioned on the wrong side of the trade. This is one reason why our sentiments are “neutral” on several the asset classes we use in client portfolios. We’d much rather hit singles and doubles and “respect the tape” (pay attention to what trends are telling us) than swing for the fences and strike out.

Written by Alex Durbin, Portfolio Manager