Estate Planning Essentials: Securing Your Legacy and Protecting Your Loved Ones

February 23, 2024

To Inform:

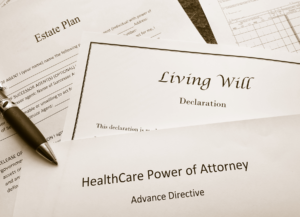

Estate planning is a crucial aspect of financial management that often gets overlooked. It involves preparing for the distribution of your assets and the management of your affairs in the event of incapacity or death. By creating a comprehensive estate plan, you can ensure that your wishes are carried out, minimize potential conflicts among your heirs, and provide for the financial security of your loved ones. Here are some essential components of estate planning that everyone should consider:

Will and Trust: A will is a legal document that outlines how you want your assets to be distributed after your death. It also allows you to name a guardian for minor children. A trust, on the other hand, is a legal arrangement that can help manage your assets and provide specific instructions for their use. Trusts can also help avoid the probate process, maintain privacy, and protect assets from creditors.

Power of Attorney: A power of attorney is a legal document that designates an individual to make financial and legal decisions on your behalf if you become incapacitated. There are different types of powers of attorney, including general, limited, and durable powers of attorney. It’s important to carefully consider who you appoint as your agent and discuss your wishes with them.

Healthcare Directives: Healthcare directives, such as a living will and a healthcare power of attorney, outline your preferences for medical treatment and appoint someone to make healthcare decisions for you if you are unable to do so. These documents ensure that your wishes regarding medical care are known and respected.

Beneficiary Designations: Many assets, such as life insurance policies, retirement accounts, and bank accounts, allow you to name beneficiaries. It’s important to review and update these designations regularly to ensure they align with your overall estate plan.

Guardianship Provisions: If you have minor children, it’s essential to designate a guardian who will care for them in the event of your death or incapacity. This decision should be made thoughtfully and communicated clearly with the chosen guardian.

Estate Tax Planning: For individuals with significant assets, estate tax planning is a critical consideration. Various strategies, such as gifting, setting up trusts, and leveraging tax exemptions, can help minimize the tax burden on your estate and preserve more of your wealth for future generations.

Regular Review and Updates: Estate planning is not a one-and-done task. It’s important to review and update your plan regularly, especially after major life events such as marriage, divorce, births, deaths, or significant changes in financial circumstances.

Estate planning is an essential part of overall financial planning that should not be overlooked. By taking the time to create a comprehensive estate plan that includes wills, trusts, powers of attorney, healthcare directives, and other essential components, you can provide for the orderly distribution of your assets and the well-being of your loved ones. This information is for educational purposes only. The Joseph Group is not a law firm and no portion of this should be construed as legal advice. Consulting with an experienced estate planning attorney can help ensure that your plan is tailored to your specific needs and goals and if you do not have an estate attorney, we can refer you to one.

Written by Jake Martin, Client Advisor