Fed Rate Cuts: Why is More Important Than When

January 19, 2024

To Inform:

Earlier this week, Alex and I hosted our January Portfolios Event – “7 Themes Plus One More for 2024.” One of those themes discussed our view on one of the biggest questions we are receiving from clients – potential interest rate cuts by the Fed in 2024.

All signs point to the Fed cutting rates in 2024, but we believe when they start isn’t the biggest question. The more important question for markets is WHY is the Fed cutting rates.

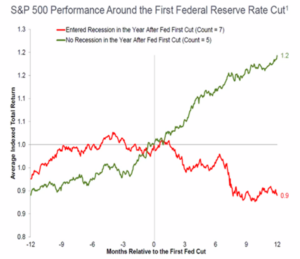

The green and red lines in the chart below reflect the culmination of twelve historic instances of the Fed cutting rates. The red line reflects the performance of the S&P 500 in seven of those instances when the economy entered a recession in the year the cutting cycle began. The green line on the other hand, reflects the performance of the S&P 500 in five instances when there was no recession in the first year after the first rate cut. As you can see, there is a pretty big difference!

Source: Bloomberg

So, if the Fed is poised to cut interest rates in 2024, why are they doing it? Are they doing it because inflation is declining, and rates don’t need to be as high? Or is the Fed cutting because there are signs of a slowdown, and they are trying to prop up the economy?

We believe if the Fed is cutting rates because inflation is heading down and is close to the Fed’s 2% target, it could be a huge tailwind to markets. Removing the weight of higher interest rates in an economy with full employment and positive growth is likely to support corporate earnings and investor confidence. On the other hand, if the Fed is cutting because they are seeing signs of economic weakness, it could be too late to avoid a recessionary scenario.

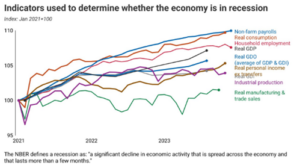

Fortunately, economic indicators are trending up (as shown in the chart below) while the rate of inflation is trending down, so the more optimistic scenario is looking like the more likely one.

Source: Hamilton Lane

You may be thinking, “ok, I get it – why the is Fed cutting rates is the more important question, but I still want to know when are these rate cuts likely to start?”

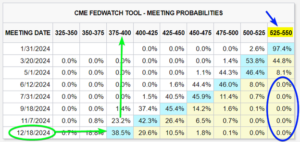

One of the best tools we have for looking at timing of Fed actions comes from the Chicago Mercantile Exchange and specifically their CME Fed Watch tool. CME Fed Watch looks at the market implied probabilities the Fed will change interest rates at upcoming meetings based on pricing in the Fed Funds futures market. In other words, when we look at the times the Fed meets throughout 2024, what is likely to happen with interest rates?

There is a lot going on in the table below, but let’s unpack it. The current Fed Funds rate is shown with the blue arrow – a current range of 5.25% – 5.50%. The light blue shaded boxes show the most likely probability of what rates will be after each meeting. At the January 31 meeting, there is currently a 97.4% change rates will be unchanged, but at the March 20th meeting, there is a 53.8% chance rates will be lower by 0.25%. In other words, in March, there is better than 50/50 odds the Fed will start cutting rates!

Going further out into the year gets more interesting. Notice the 0.0%’s within the blue circle. These 0’s imply a 0% chance rates will be at current levels after the Fed’s June meeting. Or, said differently, the market is implying a 100% chance the Fed will begin cutting rates by June!

The end of the year is reflected by the green circle and arrows. After the Fed’s December 18, 2024, meeting (a little less than a year away), the most likely probability (38.5%) is that the Fed Funds rate will be in a range of 3.75% to 4.00%…that implies six 0.25% rate cuts this year!

Source: CME Fed Watch as of January 18, 2024

Putting it all together, the Fed is poised to cut rates in 2024. The market currently believes the cuts are likely to start in March (but June at the absolute latest) and we could see six rate cuts throughout this year.

As with all things in markets, forecasts and probabilities are subject to change. However, if the Fed is cutting rates, and doing it in response to lower inflation with an economy still at full employment, it paints a very positive backdrop for corporate profits and economic activity, and in turn the stock market.

Written by Travis Upton, Partner and Chief Executive Officer