Five Themes (+1) for 2021

December 18, 2020

To Inform:

Earlier this week we had our final Portfolios at Your Place of the year and discussed our Five Themes (+1) which are key items of discussion in our Investment Strategy Team meetings as we approach 2021. We will likely be unpacking each of these more in depth in the weeks and months ahead, but for those who were unable to attend this week’s action-packed event, here is a summary of those themes:

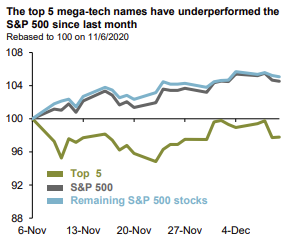

- Impact of Vaccine – Focus on Innovation and Cash Flow. As the stocks recovered from their lockdown plunge earlier this year, leadership was narrow and dominated by a few big technology companies. Through the end of November, although the S&P 500 had positive performance YTD, all of that performance came from the top 5 companies in the index and the average of the remaining 495 companies was negative. All of that changed in a big way in November after the election and positive vaccine news. Small cap stocks had their best performance month in history (as measured by the Russell 2000) and “value” style stocks outperformed “growth.” As vaccines are being approved and being administered throughout the world, analysts estimate over 50% of the U.S. population will be vaccinated by March/April of next year, potentially leading to a surge in economic demand. All of this provides a positive backdrop for stocks, but leadership may come from different areas in 2021 than it did in 2020.

Source: JP Morgan Asset Management

- Lessons from history – should we look back from 2020 or 2010? Despite small print disclaimers of “past performance is no guarantee of future results” many investors fall prey to the fallacy that what performed best in the recent past will continue to be the best performer in the future. If we look backward 10 years from 2020 (the decade from 2010-2020), one of the best performing asset classes was large U.S. stocks. However, valuations and market leadership today actually have more in common with the decade from 2000-2010. Looking at lessons from history, it may behoove investors to look backward starting from 2010 (the decade from 2000-2010). That was a decade where performance of large U.S. stocks (as measured by the S&P 500) was negative but positive returns came from a broad range of other asset classes including foreign stocks (especially emerging markets), commodities, and smaller, more value-style stocks here in the U.S.

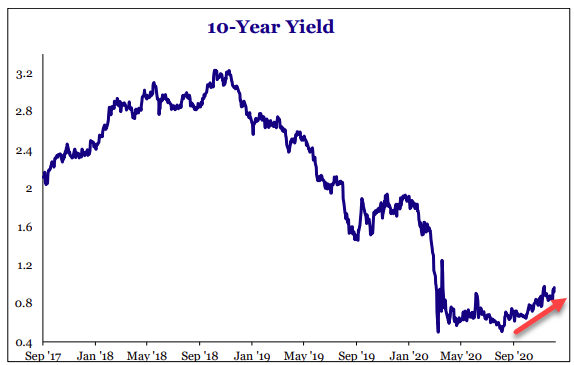

- Can bonds still play their historical role in portfolios? As I type, the current interest rate on the 10-year Treasury note is 0.94%. Over the last three years, high quality bonds (as measured by the Barclays Aggregate Bond index) have returned over 5%, but bond prices, which rise as market interest rates fall, were supported by falling interest rates (see chart below). Looking forward, mathematically, it is almost impossible for bonds to generate similar returns and especially from such a low starting rate, bond prices would be vulnerable if interest rates rise. When it comes to providing income and hedging stock market risks, we believe that bonds still provide insurance value but investors need tools other than traditional bond exposure.

Source: Strategas Research Partners

- Direction of the Dollar and Asset Class Leadership. We are seeing multiple research reports supporting the conclusion that deficits and changes in government policy will lead the U.S. dollar into a cycle where it is weaker against other currencies throughout the world. The dollar has been through cycles of strength and weakness before and a weaker dollar tends to provide a tailwind to asset classes such as international stocks and commodities. Interestingly enough, the last major weak dollar cycle happened from 2003-2010 (see point number 2).

Source: Capital Group

- Liquidity Matters. We don’t think it is any coincidence the market bottom this year on March 23rd coincided with a massive surge in the money supply with the Federal Reserve providing liquidity to support markets. We believe a change in liquidity conditions, positive or negative, could have significant implications for broad market direction. With Jerome Powell remaining in charge at the Fed, and former Fed Chair Janet Yellen appointed to serve as Treasury Secretary, pro-liquidity policy makers seem to provide a positive backdrop for stocks.

Bonus +1. What is the surprise going to be and how will we respond? While we are wrapping up 2020 and making plans for 2021, we have the humility to know 2021 could have its own surprises. We certainly hope and pray those surprises are good ones but as the famous sage of wisdom Mike Tyson once said, “everyone has a plan until they get punched in the mouth.” We certainly didn’t expect a global pandemic in 2020 but as we wrap up the year, we feel our clients were able to navigate through it successfully. We believe key to that success was a wealth allocation framework where client portfolios were aligned with objectives allowing us to make decisions in stressful times based on logic rather than emotion. While we don’t know all of things 2021 may have in store, we do know we have a foundation through our objective based portfolio framework to handle the surprises.

This WealthNotes article was written by Travis Upton, Partner, CEO and Chief Investment Officer