Flat and Frustrated

June 16, 2016

FLAT and FRUSTRATED – those are the words to describe the stock market and the mood of investors respectively.

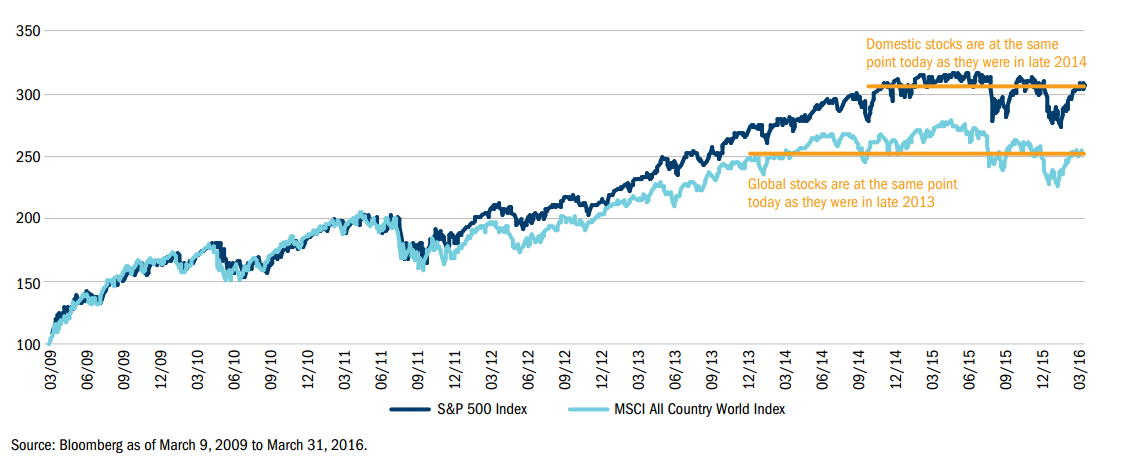

FLAT: To put it in perspective, we’ve been having good conversations with clients about the chart below. The chart shows the world stock market (light blue line) and the U.S. stock market (dark blue line) since “The Great Recession’s market bottom” in March of 2009. Both the world and U.S. market graphs have nice upward slopes, reflecting gains, but there is one big problem – the lines have plateaued. Today, the U.S. stock market is essentially at the same place it was in late 2014 and the World stock market (which includes U.S. and foreign) is at the same place it was in late 2013.

Bloomberg, Columbia Threadneedle

FRUSTRATED: The flat markets mean investors are frustrated, as they have seen little gains from broad market exposure for over 18 months or longer. The problem is exacerbated when you consider that the U.S. stock market has been one of the best performers around. Asset allocation has provided little help as other asset classes such as high quality bonds, high yield bonds, and real assets (commodities and real estate) have performed in line or worse than U.S. stocks.

Investors may not be able to control the markets, but it’s important to be smart in responding to what the market is doing. Two things are especially important:

1. In this flat, range-bound environment it is important to consider where you can “get paid to wait” for markets to break out of their trading range. Dividend-paying stocks and interest-paying securities like high yield bonds are areas where we are seeing leadership.

2. Be prepared to respond to changes in direction, but be patient. At our investment strategy meeting this morning, we discussed two conference calls with noted money managers our team participated in this week. One call laid out a logical case for why the market might decline, while the other call laid out an equally logical case why the market could break out to new highs. At The Joseph Group, we’ve been working out our action plan for responding by shifting allocations to either scenario within client accounts. In the midst of conflicting signals and up and down markets, we’re being patient, but we know the flat plateau will not last forever, so we are also getting prepared.