From Sugar Rush to Lasting Recovery

April 16, 2021

To Inform:

Recent economic data has confirmed the recovery is on a solid footing. Retail sales, surveys of manufacturing and service businesses, and jobs numbers have all shown tremendous strength in recent weeks. With so many focused on the immediate reopening of the economy, it is worth asking what might come next. Is this just a sugar rush fueled by government stimulus payments? Can the economy stand on its own two feet?

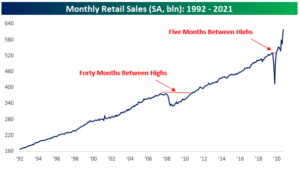

Recent figures on retail sales have shown just how quickly this number has recovered in the United States. The sharp and deep drop in the first few months of 2020 took only five months to recover. To put this in perspective, the recovery to previous highs in retail sales after the recession of 2008-09 took forty months. Recent year-over-year growth in this number clocked in at nearly 10%. Looking at this data, it’s safe to say that consumers are back (for now). One key element in this recovery of consumer spending is the final round of stimulus payments to households. A family of four meeting the income thresholds would have received $5,600 in this most recent round.

Source: Bespoke Investment Research

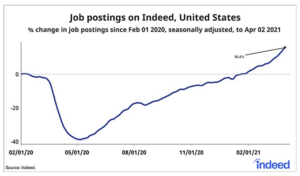

A crucial factor that ensures the recovery from the lockdown induced COVID economic shock is people returning to work. While unemployment claims have dropped in recent months and monthly job gains are flirting with the 1 million mark, the U.S. has not yet returned to employment levels seen before March of 2020. In some areas of the country that are less open, the demand for labor may not yet be there. In aggregate, the demand for labor seems to be spiking. One useful source of data is from Indeed.com, an online jobs board. At the beginning of April, job postings were up 16% over levels seen at the beginning of last February, before COVID-19 was declared a pandemic.

Source: Indeed.com

For the economy to move from stimulus-fueled sugar rush to a more durable recovery, getting people back to work is essential. Stimulus payments and unemployment checks are limited by the government’s ability to spend. As workers and consumers move forward in the months ahead, a steady paycheck will be what is needed to ensure bills are paid and businesses continue to thrive. The data we are seeing is encouraging.

Written by Alex Durbin, Portfolio Manager