Geopolitics and Market Behavior are Historically Two Different Things

February 25, 2022

To Inform:

I have a chair at home I sit in every morning where I have my coffee and devotional time. Often toward the end of that time I will read the Wall Street Journal and look at the news. The headlines and pictures of explosions in Ukraine stir a fury of emotions. Our prayers go out to the Ukrainian people.

Since I was by myself yesterday morning, I unfortunately don’t have proof of this, but Thursday morning when I saw the stock market futures indicating the Dow would open down over -800 points I actually said to myself “it would not surprise me if the market had a big reversal and closed positive.” That’s exactly what happened – mid day the market had a massive reversal and major market indexes finished with gains across the board. As I type this on Friday morning, market gains look set to continue.

We’ve been having a lot of conversations with clients this week and clearly emotions are high. Let’s run through four of the key things we have been discussing the last few days, seeking to separate emotion from logic as we approach the markets.

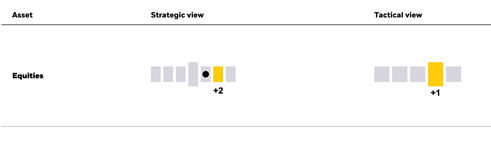

First, we’ve tried to gather outside perspectives from Wall Street and other research firms. On Wednesday night, I was on a call with Goldman Sachs where they said to expect volatility, but reiterated their 4,900 2022 price target for the S&P 500, implying new all-time highs and double-digit gains from current levels. Paraphrasing Goldman, “geopolitics will lead to volatility, but continued growth in corporate profits should ultimately lead to market gains.” Also, BlackRock put a note out earlier this week recommending clients increase their overweight exposure to stocks. According to BlackRock, “the early 2022 selloff creates a compelling opportunity for the long-term investor as we see the combination of low real rates, strong growth, and reasonable valuations as favorable for stocks.”

Source: BlackRock

Second, in times of market stress, investor sentiment can be a great tool for assessing whether it’s time to “hold ‘em or fold ‘em.” As many WealthNotes readers know, one of our favorite sentiment indicators is the Smart Money/Dumb Money Confidence indicator. In general, investors want to follow the “smart money” institutional hedgers and do the opposite of “dumb money” more emotional individual investors. When the behavior of the two groups move in opposite directions it can point to important market turning points.

Source: SentimenTrader.com, Sundial Capital Research

On Wednesday, the “Smart Money” was showing buying behavior and the “Dumb Money” was showing selling behavior to the biggest extreme since the beginning of COVID, indicating conditions which have historically lined up with attractive buying opportunities (or at least not selling).

Third, we like to look at the behavior of high yield, or junk bonds as an indicator of credit market stress. I would say one of investors’ biggest fears is that a correction (defined as a downturn of -10%) could turn into a bear market (defined as a downturn of -20% or more). Historically, most major market declines (2008 being a prime example) are associated with problems in the credit markets. Heading into Thursday, high yield bond spreads were little changed over the last few weeks and remained at historically low levels. Our read on those numbers was, so far, this is a geopolitical and emotional event for stocks, but NOT something which was pointing to a bigger economic impact.

This morning I exchanged emails with good friend Bill Zox, portfolio manager at Brandywine Global. According to Zox, “what we have seen in high yield is consistent with what we have seen in past cycles before the first Fed rate hike. The drawdowns do not suggest a much higher probability of a recession.”

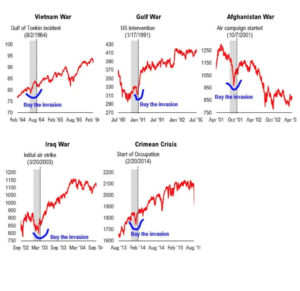

Finally, it is informative to look at lessons from history. “History does not repeat itself, but it often rhymes” is one of my favorite Mark Twain quotes and I think the quote may have validity today. Every geopolitical event is different, but the collection of charts below shows the market behavior around past geopolitical events. The message from history is that market contractions are common around geopolitical events (gray bar) but markets tend rally once the invasion starts.

Source: Fundstrat

We don’t take what is happening in our world lightly. We don’t take the responsibility and privilege we have in managing objective-based portfolios on behalf of our clients lightly either. It’s our job to separate emotion from logic and often that can mean standing firm in the midst of the chaos, and in this case, recognizing that geopolitics and market behavior can be two very different things.

Written by Travis Upton, Partner, CEO and Chief Investment Officer