Get Organized!

April 28, 2023

To Inform:

Another tax season has officially come and gone with the “celebration” of Tax Day on Tuesday, April 18th! Hopefully much of the stress surrounding taxes has subsided as most people have filed their income tax returns and can now look forward to enjoyable spring activities. Golf anyone?

One reason tax season is stressful is it forces many of us to realize we lack organization, specifically as it relates to our financial documents.

- Where did we put those charitable donation receipts?

- What’s my login to download 1099s?

- Do I have all my W2s?

- The list goes on…

The Tax Day deadline is an effective motivator to gather pertinent documents, even if just long enough to drop off at your tax preparer’s office.

But what about financial documents that don’t have an annual deadline requiring us to locate them? Do you have a centralized storage area? Do you have redundant copies, preferably in electronic form? Could your spouse or significant other locate them? Disorganization can cost us time and money.

(Author’s note: Financial advisors are not immune; I was late renewing my license because I couldn’t find my birth certificate. The late renewal fee and replacement birth certificate are dollars that could’ve been used elsewhere!)

So, where to start?

- Gather all your financial documents in one place.

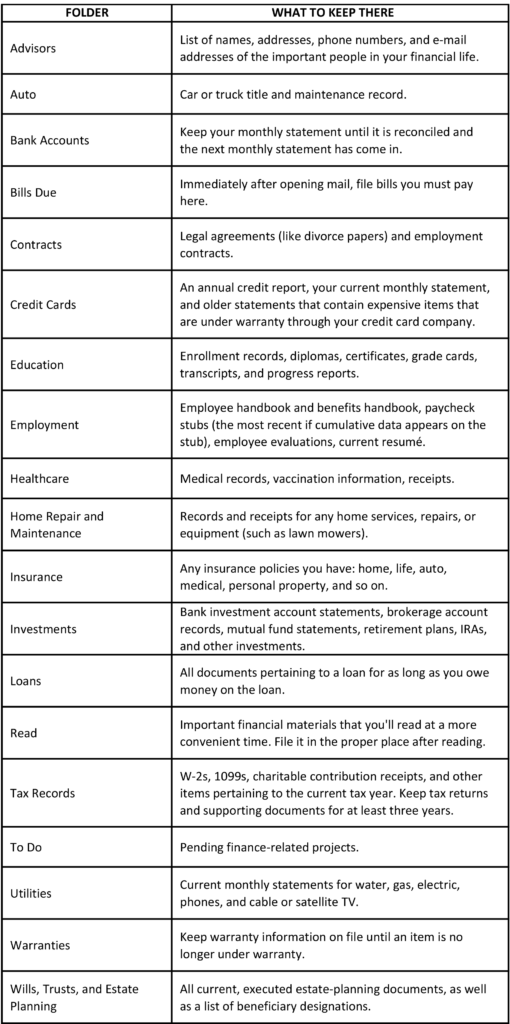

- Develop a filing system with easy-to-understand folder names.

- Scan hard copies to create an electronic version.

Below is an example filing system that could be applied to you.

Tips:

- Be consistent when you save your documents, use the same folder each time

- Maintain a naming convention for your files, ideally including the date. For example, an investment statement could be labeled “03.31 ABC Investment Account”

- Keep your folders current

Why is it important?

Proper storage and organization of your financial documents can save you time and money when the need arises to locate your records. Often, one spouse is more heavily involved in finances than the other, but what happens if the knowledgeable spouse is unavailable, incapacitated, or deceased? What if your children need to locate your Will or other estate documents? The list goes on.

This may seem like a lot of work (which it is!) but only at first. Once you have a system and all the documents saved, the folders just need updated as new information comes in.

Questions about what to save? Need help locating investment statements, beneficiary designations, or other financial materials? Give us a call, we are happy to help.

Written by Matt Zimmermann, Client Advisor