Gradually, Then Suddenly

December 15, 2023

To Inform:

The phrase “Gradually, then suddenly” entered the vernacular through Ernest Hemingway’s The Sun Also Rises. While the characters in Hemingway’s novel were discussing how one of them went bankrupt, we get to talk about a much more pleasing subject, and that is Fed interest rate policy (I said pleasing, not fun!). To borrow from Hemingway perhaps we can imagine a conversation between a reporter and Federal Reserve Chairman Jerome Powell. “Mr. Powell, how have the market’s expectations for Fed rate cuts shifted?” Powell’s response could simply be “Gradually, then suddenly.”

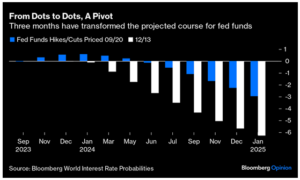

In financial circles much of the last year has been spent debating if and when the Fed would be cutting rates. This debate was informed by Fed officials’ public statements and the regular stream of inflation and labor market data. Peak “hawkishness”, another word to describe tight conditions, was reached in September, when 10 members of the Fed’s Board of Governors thought rates would be at 5% or higher at the end of 2024. Today, that number is just three, and Fed Funds futures contracts are now pricing in six cuts by January of 2025, compared to just three in September.

Source: Bloomberg

Why the sudden change? Well, as said earlier, what markets suddenly realized this week was something that had gradually been happening over the last several months. Two of the factors the Fed has been paying attention to in setting interest rate policy have been changes in the rate of inflation and data from the labor market.

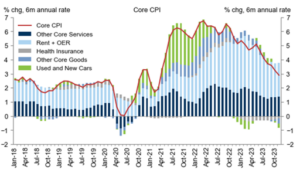

Inflation data has steadily been declining, albeit not to levels that would satisfy the Fed (the fabled 2% target). This doesn’t imply that prices are broadly falling, though goods inflation (the tangible stuff we all buy) along with car prices have actually turned negative in recent months.

Source: Goldman Sachs

The labor market, either by looking at monthly new jobs created or job openings, is still strong but not at the levels seen last year and earlier this year. This signifies more balance in the labor force and gives the Fed confidence that the risk of an inflationary “wage-price spiral” is limited.

Source: Bloomberg

All of these data points have been rolling in for markets to process throughout the last several months and expectations for the Fed to cut rates in 2024 have gradually been increasing since October. The “suddenly” was in this week’s press conference with Fed Chairman Powell in which he said, “We’re aware of the risk that we would hang on too long. We’re very focused on not making that mistake.” In saying this, Chairman Powell gave the clearest signal yet that rate cuts are in the offing.

You can see the market’s sudden response in the chart below. Since markets hit a recent near-term low on October 27th the stock market is broadly higher. An ETF that tracks intermediate-term government bonds is up 7.5% as bond yields have declined. What’s most interesting, though, is the areas of strength. An ETF that tracks small cap stocks is up 22.5% and an ETF that tracks regional banks is up a whopping 38.5%. These corners of the market are considered to be some of the most sensitive to changes in the Fed Funds rate and their gradual outperformance against an ETF that tracks the S&P 500 leapt higher on this week’s news.

Source: YCharts

There aren’t often moments like this in markets, but a decided shift in investor psychology and expectations can transform markets and change leadership. We’ve talked a lot about the “Magnificent 7” stocks this year. If this shift in expectations ends up being accurate, the next time we use “gradually, then suddenly” to discuss behavior in markets could be the shift in leadership away from the Magnificent 7.

Written by Alex Durbin, CFA, Portfolio Manager