Grounding Your Portfolio: The Case for Real Assets

September 26, 2025

To Inform:

The Joseph Group’s Investment Committee met this week. Among the agenda items was a regular exercise where members rank their asset allocation views (underweight/neutral/overweight) across the five primary asset classes we use in constructing client portfolios. It’s always an interesting exercise, and usually one that stimulates interesting debate. One asset class discussed was Real Assets. When discussing our views here, Travis Upton, TJG’s CEO made an interesting observation – our use of real assets at all is somewhat of an “overweight.”

Now, what does that mean? Well, the portfolios we manage that invest in these five asset classes all have “neutral” or strategic targets. For Provision and Harvest portfolios, that target is 10%. In making his observation, Travis recognized the fact that many of our peers in the industry, while perhaps allocating to Real Assets from time to time, typically don’t have a strategic, long-term allocation to the asset class. So, why do we?

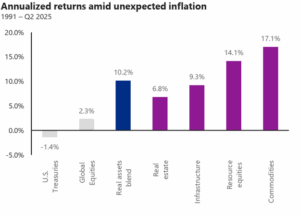

One objective in allocating to real assets is to protect against rising or “surprise” inflation. The chart below highlights the performance of a variety of Real Asset classes that tend to be more sensitive to inflation in “surprise” inflation environments. Note the diversification benefits relative to owning traditional stocks or bonds.

Source: Cohen & Steers

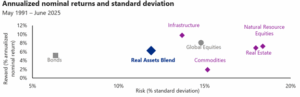

Our other primary objective in owning this asset class is capital appreciation. Our definition of Real Assets incorporates a wide swath of tangible investments – something you could see with your eyes or touch with your hands. This includes commodities (think gold, silver, copper, corn, wheat, oil, etc.), natural resource stocks (miners, energy companies, agriculture companies), infrastructure stocks (railroads, utilities, cell towers, airports), and real estate stocks (data centers, office buildings, warehouses, apartment homes). All these types of assets have the potential to grow in value, particularly the latter three. The graph below from Cohen & Steers shows the performance of the categories of Real Assets listed above over the last 30+ years. Blending them together has resulted in a return profile better than bonds with less risk than global stocks.

Source: Cohen & Steers

A final benefit is the diversification benefit. The types of economic data news that drive the returns of traditional stocks and bonds also have an impact on Real Assets, but they act in a different manner. Supply constraints, both in commodities but also in infrastructure and real estate, can be a powerful driver of price returns. This year it has been widely noted that there have been supply constraints in commodities as varied as beef, copper, and coffee. Data centers and warehouses have little vacancy. Real Assets can capture some of the economic value provided by owning these types of assets.

The diversification benefit has been evident in 2025. Using indexes, a balanced portfolio that invests in natural resource stocks, infrastructure stocks, and real estate stocks (the way we target Real Assets in Harvest portfolios) this year is up ~13.6%, while a blended portfolio of stock and bond indexes is up ~8.4%.

Our belief is that in a world of tangible investment opportunities, having economic exposure to them makes a good bit of sense. Ultimately, the Investment Committee ended up ranking the desired target for Real Assets in client portfolios as “neutral,” but not for lack of conviction in the asset class. We know the very presence of these investments in client portfolios is unique, but we believe they remain a critical tool in delivering the investment objectives in the client portfolios we have the privilege of managing.

Written by Alex Durbin, CFA, Chief Investment Officer